490,000 1st DOT Refinance Bridge Loan

A borrower had owned a valuable commercial parcel since 2013 and faced a recent financial setback and needed short-term liquidity to pursue a new property opportunity. The borrower needed a flexible, fast-moving lender that could underwrite based on asset value and a clear exit strategy.

$400,000 2nd DOT Refi/Remodel Bridge Loan

A real estate investor and business owner needed financing to complete a value-add project in the Little Italy section of downtown San Diego. The reconfiguration of three existing residential units into five rental units within a mixed-use property. The borrower sought a lender that could offer a creative and secure funding solution, including cross-collateralization, to complete the upgrade without relying on third-party financing.

$1,160,000 1st DOT Purchase/Bridge Loan

A close family member of a long-time Fidelis client needed short-term financing to purchase and renovate a single-family home in Carlsbad, CA. Though structurally sound, the property required significant updates to maximize its market potential and achieve a profitable resale within a tight timeline.

$2,325,000 1st DOT Refinance/Bridge Loan

An experienced developer with a strong design-build track record sought financing to renovate and activate a large-scale hospitality property in Julian, CA. Although the property was acquired for $1.95M in cash, the borrower required capital to complete significant improvements that would transform the site into a luxury event and lodging venue. Given the property’s scope—spread across 11 legal lots with multiple structures—a lender was needed who could underwrite based on vision, proven borrower performance, and long-term value creation.

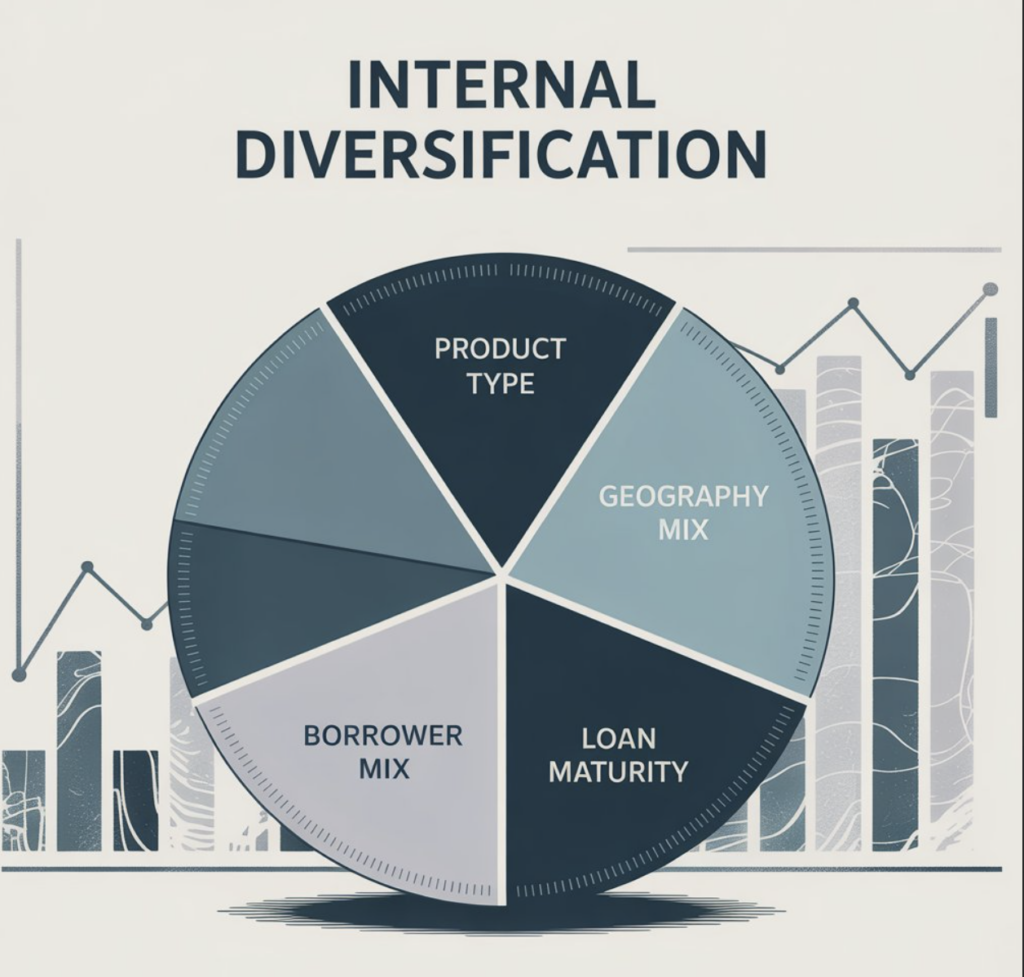

How Diversification Within a Mortgage Fund Lowers Investor Risk

Diversification is one of the most well-known tools for managing investment risk — yet many investors overlook how crucial it is within a specific fund, not just across asset classes. At Fidelis Private Fund, we believe that how a mortgage fund manages internal diversification can be just as important as where investors place their capital. […]

The Truth About Bank Loans: Why Many Developers Are Switching to Private Financing

Real estate development moves fast, and in a competitive market, securing financing quickly can make or break a deal. Traditional bank loans, while offering lower interest rates, often come with long approval timelines, rigid underwriting, and excessive documentation requirements. That’s why an increasing number of real estate developers are turning to private lending as a […]

How Inflation Affects Private Lending and What Investors Should Expect

Understanding the Relationship Between Inflation and Private Lending Inflation influences nearly every sector of the economy, and private lending is no exception. As the cost of goods and services rises, so do interest rates, borrowing costs, and overall investment dynamics. For private lenders and investors, understanding these shifts is crucial for making informed decisions and […]

How Interest Rate Changes Impact Mortgage Fund Performance

Understanding the Relationship Between Interest Rates and Mortgage Funds Interest rates play a pivotal role in shaping the performance of mortgage funds. As economic conditions fluctuate, central banks adjust rates to either stimulate growth or control inflation. For mortgage fund investors, these rate changes can impact returns, risk levels, and borrowing demand in significant ways. […]

Why Private Lending is the Secret Weapon for Scaling a Real Estate Portfolio

When it comes to real estate investing, speed, flexibility, and strategic growth are the three pillars of success. While traditional banks and financial institutions may offer lower interest rates, their rigid requirements, lengthy approval processes, and stringent underwriting can slow down an investor’s ability to capitalize on opportunities. This is where private lending steps in […]

How Flexible Loan Terms Can Make or Break Your Next Real Estate Deal

Whether you’re a seasoned developer or a first-time investor, securing funding quickly and on your terms can be the difference between seizing a golden opportunity or watching it slip away. That’s where private lending shines. Unlike traditional bank loans, which often involve extensive documentation and approval processes, private lending offers the speed, flexibility, and strategic […]

I am text block. Click edit button to change this text. Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

I am text block. Click edit button to change this text. Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.