Fidelis Brokered Loans

Fidelis Private Fund offers one stop solution service for both bridge and permanent financing. John Lloyd, CEO and the team at Fidelis have a wide network of relationships with banks, investors, and other types of lenders in California and throughout the United States. We have the experience and capacity to connect you with the right lender with the right terms. Below are a few stories of recent brokered loans. If one of these stories piques your interest and you’d like to learn more or explore how we may help you, please contact us.

$1,700,000 Refi./Perm. Loan – Brokered

A client of Fidelis needed to refinance a 15-unit multi-family property in San Diego to pull cash-out and secure a long-term fixed interest rate. As the broker, Fidelis facilitated the loan arrangement through a commercial bank, obtaining favorable terms for the client.

$795,000 Purchase/Perm. Loan – Brokered

A client required a conventional loan to buy a single-tenant, owner-occupied office/warehouse condominium in Chula Vista, CA. Fidelis Private Brokerage co-brokered the loan with Secure Funding Group to secure the loan, and successfully arranged financing with a local bank, obtaining favorable terms for the client.

$1,410,000 Refinance/Perm. Loan

Fidelis provided the construction loan to a repeat client to transform a single-family residence into a six-unit multi-family property in San Diego, which added substantial value.

The borrower wanted to keep the property as a long-term rental. When the project was complete and stabilized, the borrower requested our assistance in obtaining a conventional permanent loan with the best possible terms.

Fidelis Private Fund arranged a $1,410,000 1st Trust Deed permanent loan with a local San Diego credit union.

$1,420,000 Refinance/Perm. Loan

Fidelis provided the construction loan to a repeat client to transform a single-family residence into a six-unit multi-family property in San Diego, which added substantial value.

The borrower wanted to keep the property as a long-term rental. When the project was complete and stabilized, the borrower requested our assistance in obtaining a conventional permanent loan with the best possible terms.

Fidelis Private Fund arranged a $1,420,000 1st Trust Deed permanent loan with a local San Diego credit union.

$600,000 Refi. Cash-Out/Perm. Loan

A repeat client was looking to refinance his rental investment property in Pasadena, California, and take out additional funds to be utilized on his other rentals. Fidelis Private Fund does not offer permanent, long-term financing. However, we negotiated with a lender who could fund the loan for the borrower while providing the best terms possible through conventional financing.

$425,000 Refi. Cash-Out/Perm. Loan

A repeat client wanted to refinance his primary residence and take out additional funds to expand his business. Fidelis Private Fund does not fund owner-occupied residential loans. However, we negotiated with a lender who could fund the loan for the borrower while providing the best terms possible through conventional financing.

$1,600,000 Refi. Cash-Out/Perm. Loan

A returning client of Fidelis Private Fund sought to replace an expiring commercial line of credit with more advantageous terms. This financing was to be secured by a 2-unit commercial retail property in the heart of North Park, a vibrant San Diego, California community.

The borrower’s aim was to secure extended-term financing, with a preference for a 5-year duration. Fidelis Private Fund does not fund conventional loans so, we leveraged our extensive network of lender relationships to identify a conventional lender capable of providing the desired long-term loan structure and the necessary leverage requested by the borrower.

$2,750,000 Refi. Cash-Out/Perm. Loan

A loyal client of Fidelis Private Fund was seeking to refinance his multi-tenant retail investment property and access additional funds for diversifying his investment portfolio. The 1st Trust Deed loan was secured against a 3-unit commercial retail property situated in Barrio Logan, a San Diego, California community.

The borrower’s objective was to secure longer-term financing, extending up to a 10-year term. Since Fidelis does not fund long term conventional loans, we leveraged our extensive network of lender connections to identify a conventional lender capable of providing the desired long-term note and the level of leverage the borrower required.

$1,575,000 Refi. Cash-Out/Perm. Loan

Fidelis provided a $1,265,000 construction loan to a repeat client to transform a single-family residence into a six-unit multi-family property, which added substantial value.

The borrower wanted to keep the property as a long-term rental. When the project was complete and stabilized, the borrower requested our assistance to obtain a conventional permanent loan that generated cash out at the best possible terms. Fidelis Private Fund arranged a 1st Trust Deed permanent loan with a commercial bank of $1,575,000, 4.35% fixed for seven years, interest only for the first three years, 30-year amortization or approximately 60% LTV.

$680,000 Purchase/Perm. Loan

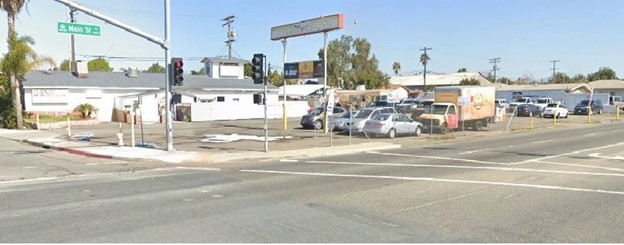

A new client, referred to Fidelis Private Fund by a reputable broker, was looking for long-term, permanent financing with maximum leverage available to purchase a storage yard in Fullerton, California.

This loan was not fit for Fidelis Private Fund. However, from our extensive network of lender relationships, we found a conventional lender that would provide a long-term note and the leverage required by the borrower.

$516,350 Refi. Cash-Out/Perm. Loan

A returning client sought to refinance their single-tenant industrial property in Spring Valley, California, to lock in long-term conventional financing and extract additional funds for other investment opportunities.

Although Fidelis Private Fund does not specialize in providing permanent, long-term financing, we negotiated with a credit union to secure the borrower a loan with the most favorable terms available through conventional financing.

$1,210,000 Refi. Cash-Out/Perm. Loan

A repeat client needed a refinance/cash-out conventional loan secured by a single-family investment property owned free and clear. The proceeds were to be used for other investment purposes.

$4,800,000 Refi. Cash-Out/Perm. Loan

Our existing bank had a client who administered a trust that owned two commercial properties, one in Jacksonville, Florida, and one in Dripping Springs, Texas. Both were owned free and clear. The trust needed to refinance the properties with conventional financing and pull cash out for investment purposes.

$1,770,000 Refi. Cash-Out/Perm. Loan

A repeat client owned, free and clear, a gas station property in Imperial Beach, CA, and needed a conventional lender to refinance a cash-out loan for other investment opportunities.

$448,000 Refi./Permanent Loan

A repeat client needed a conventional lender to refinance a bridge loan that Fidelis funded earlier in the year. The property type was a 2,300 sq.ft. office building in La Mesa, CA.

$581,250 Refi./Permanent Loan

A long-time client received construction financing from Fidelis a year ago to build an ADU on a SFR investment property in Fallbrook, CA. Now that the construction is complete and the unit is leased out, the borrower needed a conventional take-out lender to provide a long-term loan with some cash-out at the lowest rate possible.

$492,000 Refi./Permanent Loan

A long-time client received construction financing from Fidelis a year ago to build an ADU on an SFR investment property in Fallbrook, CA. Now that the construction is complete and the unit is leased out, the borrower needed a conventional take-out lender to provide a long-term loan with some cash-out at the lowest rate possible.

$390,000 Refi./Permanent Loan

A repeat client needed to quickly buy out a partner last year on a single-family investment property in Escondido, CA, and utilized the services of Fidelis Private Fund to do that. The exit strategy at the time was to refinance with permanent financing within a year.

$2,440,000 Refi./Permanent Loan

A long-time client needed to refinance an existing conventional loan secured by two retail properties on two separate parcels in the area of Mission Gorge in San Diego. The borrower’s objective was to refinance the loan with no cash-out and secure it with only one of the properties releasing the 2nd property free and clear.

$2,437,500 Refi./Permanent Loan

An experienced real estate investor and repeat client of Fidelis Private Fund needed a long-term/conventional loan with cash out to refinance an existing bridge loan on an existing 7-unit apartment, cottage-style, in North Park. The borrower wanted a conventional lender at the lowest interest rate possible.

$904,000 Refinance/Permanent Loan

A new borrower referred to Fidelis Private Fund needed to refinance two maturing private notes with high-interest rates on his owner-occupied single-family residence in Rancho Mirage and wanted a long-term loan.

Fidelis does not fund owner-occupied residential loans. However, we were able to arrange a loan with another lender through our network of lender relationships at loan terms acceptable to the borrower.

$5,522,000 Refinance/Construction Loan

A client needed a construction loan to build 17 apartment units in Lemon Grove, CA. The borrower needed a lender to provide a higher leveraged loan than the typical institutional lender would provide or approximately 80% loan to cost.

This loan was not a fit for Fidelis Private Fund. However, from our extensive network of lender relationships, we found a non-conventional lender that would provide the leverage required by the borrower to complete the project.

$340,000 Purchase/Permanent Loan

A repeat borrower of Fidelis Private Fund needed to close within 3 weeks on a purchase of an owner-occupied single-family residence and needed a long-term loan.

Fidelis does not fund owner-occupied residential loans. However, through our extensive network of lenders were able to negotiate with a lender who could fund the loan for the borrower with an expedited appraisal process.

$350,400 Refinance/Permanent Loan

A repeat client was looking to refinance her primary residence to take advantage of lower interest rates. Fidelis Private Fund does not fund owner-occupied residential loans. However, we negotiated with a lender who could fund the loan for the borrower while offering one of the lowest interest rates possible.

$1,185,000 Refinance/Permanent Loan

A repeat client needed to refinance his primary residence in La Jolla, CA, simply wanting to lower the interest rate on his existing mortgage.

$1,100,000 Refinance/ Perm Loan

After paying all cash for a luxury residential condo in La Jolla as a second home earlier in the year, the borrower wanted to refinance to pull cash-out for other investment opportunities.

$10,300,000 Purchase / Bridge Loan

A repeat client of Fidelis was in contract to purchase two retail multi-tenant buildings totaling approximately 47,500 sq.ft. in a mixed-use project located in the Barrio Logan neighborhood southeast of downtown San Diego. The borrower needed a bridge lender to close fast and allow time to transition several of the retail tenants and stabilize the property.

$2,075,000 Refinance/SBA Perm Loan

A long-time existing client wanted to refinance a private money loan with an SBA long-term loan for their board and care facility that they have owned and operated for over 15 years.

$1,540,000 Purchase/Perm Loan

A self-employed borrower needed to close on purchasing an owner-occupied single-family residence with as much leverage as possible with a long-term loan.

Fidelis does not fund owner-occupied residential loans. However, we were able to negotiate with a conventional lender who could fund the loan for the borrower while providing the leverage required by the borrower.

$3,450,000 Purchase/Bridge Loan

A repeat client of Fidelis was in contract to purchase two commercial multi-tenant office buildings, 100% leased, totaling approximately 23,400 rentable sq.ft. located in Bonita, CA. To limit the cash down payment, the borrower needed a creative broker to arrange bridge financing with a mezzanine loan.

The purpose of the bridge financing was to allow time to raise rents, add a new cell tower lease, and stabilize the property at a higher value in preparation for refinancing with a conventional lender.

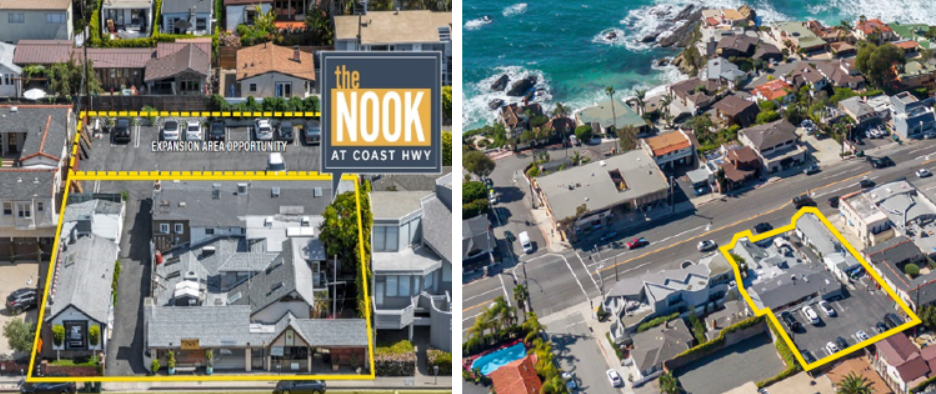

$1,985,000 Refinance/ Permanent Loan

Fidelis funded a small $150,000 mezzanine bridge loan directly on a mixed-use commercial/residential property in Laguna Beach, CA to help the client make some property improvements. However, the borrower ultimately needed to refinance and consolidate the senior debt and the mezzanine debt into one conventional long-term loan at a competitive market interest rate.

$2,000,000 Purchase / Bridge Loan

We received a purchase loan request through a broker relationship for a four acre improved land parcel in Otay Mesa, San Diego, along the border. It was an owner-user acquisition.

The loan request was too large for Fidelis to fund as a direct lender, so we arranged the loan with another third-party lender from our extensive database of lender relationships.

$3,100,000 Refinance / Bridge Loan

A repeat borrower needed to refinance a loan that matured and consolidate debt on the property. The loan was secured by a multi-tenant retail property in Chula Vista, CA.

$650,000 Purchase / Perm Loan

A borrower needed to close on purchasing an owner-occupied single-family residence in less than two weeks and needed a long-term loan.

Fidelis does not fund owner-occupied residential loans. However, we knew a lender who could fund the loan for the borrower and meet the short time frame.

$753,250 Refinance / Perm Loan

An existing client requested the assistance of Fidelis to arrange a long-term permanent loan to pay off a private money loan with another lender on a single-family Investment property.

$434,000 Refinance / Perm Loan

Fidelis was the existing lender where the client initially needed a purchase/renovation loan on a residential duplex in National City, CA.

Once Fidelis funded the acquisition/remodel bridge loan, and the property was renovated and leased, Fidelis immediately arranged a take-out long-term permanent loan for the borrower at a low-interest rate.

$415,000 Purchase / Permanent Loan

A borrower needed to close on a purchase of an owner-occupied single-family residence with the lowest rate possible and needed a long-term loan.

Fidelis does not fund owner-occupied residential loans. However, we were able to negotiate with a lender who could fund the loan for the borrower while offering one of the lowest interest rates in the market.

$500,000 Purchase/ Perm Loan

A repeat client of Fidelis Private Fund inquired about a purchase money loan to acquire a single-family residence as his primary residence. The borrower needed a long-term loan while also needing to close within two weeks. The self-employed borrower turned to Fidelis for the guidance that they needed.

$620,900 Refinance/SBA Permanent Loan

A repeat client had purchased a residential adult care facility with private financing and wanted to refinance the higher-cost debt with conventional long-term debt at a low fixed rate.

Through our extended network of real estate lenders, we found for the borrower the best lender to provide an SBA loan with a fully amortized 25-year fixed rate.

$1,625,000 Refinance/SBA Permanent Loan

A repeat client had purchased several residential adult care facilities with private financing and wanted to refinance the higher-cost debt with conventional long-term debt at a low fixed rate.

Through our extended network of real estate lenders, we found for the borrower the best lender to provide one SBA loan, secured by the two properties, with a fully amortized 25-year fixed-rate loan.

$3,330,000 Refinance/Construction Loan

A repeat client needed a construction loan to build 17 apartment units in National City, CA. The borrower wanted a conventional lender with competitive pricing that would accommodate financing for an owner/builder.

As it is with many of our clients, private money is not always needed. Fidelis arranged the construction financing with a regional commercial bank, one of Fidelis’s many lender relationships.

$753,250 Refinance / Permanent Loan

Fidelis was the existing lender where the client initially needed a quick refinance cash-out bridge loan on a residential condo investment property with oceanfront views in La Jolla, CA.

Once Fidelis funded the acquisition and bridge loan, Fidelis immediately started the process to help the borrower refinance the Fidelis bridge loan into a long-term permanent loan at a low-interest rate.

$242,000 Refinance / Term Loan

A client referred to Fidelis wanted to take advantage of the low-interest rates available to refinance his owner-occupied single-family residence. The borrower wanted a hassle-free loan and looked to Fidelis to assist in getting it done.

$200,000 Refinance / Term Loan

A new client needed to refinance her previously free & clear primary residence with a new mortgage for investment purposes while taking advantage of today’s low-interest rates.

She was frustrated with her previous attempts to obtain financing through other loan brokers and banks and almost gave up trying. That is until she was introduced to Fidelis.

$380,000 Refinance / Term Loan

A referred client was looking to refinance his existing mortgage and take some cash out while locking in the lowest interest rate possible. The borrower wanted a hassle-free loan and turned to Fidelis to lead the way.

Fidelis quickly connected the borrower with a conventional lender that could make the loan at the lowest rate available.

$505,000 Refinance / Term Loan

A client referred to Fidelis wanted to take advantage of the low-interest rates and refinance his owner-occupied single-family residence. The borrower wanted a hassle-free loan and looked to Fidelis to assist.

$1,000,000 Refinance / SBA Term Loan

A long time client wanted to refinance his first trust deed mortgage on a commercial property. The borrower also required some cash out for working capital.

$220,000 Refinance / Term Loan

A new client looking to refinance his existing first trust deed mortgage on his owner-occupied single-family residence, while taking advantage of today’s low-interest rates. The borrower wanted a hassle-free process and turned to Fidelis for help.

$918,250 Refinance / Term Loan

A repeat client needed a conventional long-term loan to refinance out of a $918,250 private money bridge loan funded by Fidelis as the direct lender on a single-family residence in La Jolla, CA. In the era of Covid-19, self-employed borrowers such as this client may find it challenging to find a lender that can accommodate self-employed borrowers with jumbo-sized loans.

$466,000 Refinance / Term Loan

Although a new client to Fidelis, the borrower is a long-time acquaintance who was looking to refinance his owner-occupied single-family residence, simply wanting to take advantage of today’s low-interest rates. The borrower wanted a hassle-free loan process and turned to Fidelis to guide him through.

$400,000 Refinance / Term Loan

A new client was referred to Fidelis from a long time borrower and an excellent referral source to refinance an owner-occupied single-family residence. The borrower needed additional cash-out for repairs and maintenance. Frustrated with other lenders, the borrower turned to Fidelis for the guidance that they needed.

$975,000 Purchase / Bridge Loan

We received a referral from a client looking to purchase an owner-occupied industrial building in Henderson, Nevada. The client had a timing problem and needed to close before the conventional lender could fund the loan request.

$467,500 Purchase / Bridge Loan

A repeat client and experienced real estate investor called me with a loan request to purchase a single-family residence as an investment property. The loan needed to close in 9 days. There was not enough time to close the loan with a conventional lender.

$390,000 – Purchase / Bridge Loan

An investor/owner-operator was purchasing a mixed-use commercial/residential property in Spring Valley, CA. The purchase price was $600,000. The borrower was going to move his business into the commercial space and rent out the attached residential unit.

$1,200,000 – Finance the Purchase of a Note

A local private lender needed to sell the note on a single-family residential investment property in San Diego, CA, which is nestled into the slope of Mount Soledad with ocean views. The note was sold for $1,200,000 and needed to close within a week.

$695,000 Purchase / Bridge Loan

An investor/owner-operator was purchasing a single-family residential investment property in Carlsbad, CA, to be used as a sober-living facility. The purchase price was $1,259,900, with the seller willing to execute a subordinated seller carry-back note allowing the purchaser to be put no cash down.

$459,000 Refinance / Permanent Loan

A real estate broker/investor-owned a single-family residential investment property that was initially intended to be a fix & flip property. But instead, the owner decided to keep it as a rental and needed to pay off the higher cost short-term private money financing.

$4,085,000 Refinance / Permanent Loan

An experienced real estate developer and repeat client finished the construction of a 13 unit luxury apartment in the community of Mission Hills of San Diego, CA. The construction loan of approximately $3,000,000 had matured. The borrower’s objective was to refinance and leverage as large a conventional loan as possible at the lowest 10-year fixed rate available in the market with a 30-year amortization.

$7,200,000 Refinance / Permanent Loan

Fidelis Private Fund arranged the $7,200,000 permanent loan with a Life Insurance Company at a competitive 4.25% interest rate fixed for 20 years and fully amortized.

$3,440,000 Refinance / Permanent Loan

The challenge was the 17 units were master leased by one tenant providing housing for their clients. The borrower needed to buy out a partner and at the same time, capitalize on today’s low-interest rates to improve the property’s net cash flow.

$1,153,000 Refinance / Permanent Loan

Fidelis Private Fund arranged the $1,153,000 permanent loan with a lender in the low 4% interest rate range and 52% loan to value ratio.

$1,690,000 Refinance / Permanent Loan

A client needed to refinance existing higher-cost debt with a lower interest rate on a six-unit apartment in Ocean Beach. Fidelis Private Fund arranged the $1,690,000 permanent loan with a commercial bank at a competitive interest rate and 65% loan to value.

$264,000 Refinance / Permanent Loan

A client needed to refinance existing higher-cost debt with a lower interest rate on a single-family residential investment property with a detached additional dwelling unit (ADU) in Escondido, CA. The borrower wanted a conventional lender at the lowest interest rate possible.

$335,000 Refinance / Permanent Loan

A repeat client needed to refinance existing higher-cost debt with a lower interest rate and long term loan. The Fidelis Private Fund helped the borrower arrange a long term loan to refinance the three residential units at an excellent interest rate.

$640,000 Purchase / Construction/Bridge Loan

Fidelis Private Fund arranged a $640,000 acquisition/rehab bridge loan (initial disbursement of $440,000 or 80% of cost) from a private lender to accommodate the purchase and provide additional funds for the complete remodel of the property. Upon completion of the remodel the value will exceed $950,000 or 67% LTV ratio.

$476,250 Refinance / Permanent Loan

Fidelis Private Fund arranged the $476,250 permanent loan with a lender at competitive pricing considering the use of the property as an adult residential care facility.