Understanding Economic Cycles and Their Impact on Private Lending

The private lending industry, including Fidelis Private Fund, is deeply intertwined with economic cycles, as shifting market conditions influence mortgage fund yields, investment strategies, and borrower demand. While regulatory policies often constrain traditional lending institutions, private lenders have the flexibility to adapt quickly, making them an attractive option for investors seeking stable returns. By understanding how different economic phases affect mortgage funds, investors can make more informed decisions to maximize their yields and mitigate risks.

The Role of Economic Cycles in Private Lending

The Role of Economic Cycles in Private Lending

- Expansion Phase: Booming Markets and Increased Lending

During periods of economic growth, real estate markets flourish, and demand for private lending surges. Developers and investors seek capital to fund new projects, while rising property values reduce risk exposure. Mortgage funds tend to generate strong yields as borrowers are willing to accept slightly higher rates in exchange for speed and flexibility. - Peak Phase: Market Saturation and Risk Awareness

As the market reaches its peak, asset prices become inflated, and competition among lenders increases. Private mortgage funds may see tightening margins as borrowers shop for better rates. However, experienced fund managers, like those at Fidelis Private Fund, focus on risk mitigation by maintaining conservative loan-to-value (LTV) ratios, conducting in-depth borrower assessments, and actively managing market risks to protect against potential downturns. - Contraction Phase: Interest Rate Shifts and Risk Adjustments

Economic slowdowns or rising interest rates lead to tightening credit markets, reducing the availability of traditional financing. This presents an opportunity for private lenders, as real estate investors and developers turn to mortgage funds for bridge loans and short-term financing. While some lenders may face increased default risks, Fidelis Private Fund ensures continued returns by proactively adjusting lending criteria, focusing on lower-risk, high-quality assets, and leveraging deep market expertise to identify stable investment opportunities. - Recession Phase: Defensive Strategies and Selective Lending

In times of economic downturn, cautious underwriting becomes paramount. Property values may decline, and borrower defaults may rise. However, mortgage funds with diversified portfolios and strong due diligence processes can maintain stability by focusing on well-secured loans, conservative LTV ratios, and borrowers with strong financials. While these strategies reduce risk, market downturns can still impact property values and borrower repayment capabilities, making ongoing risk assessment essential.

Why Private Mortgage Funds Offer Resilient Yields

Private lending, such as the strategies employed by Fidelis Private Fund, offers a degree of insulation from the volatility of public markets, making it an attractive investment during uncertain times. Unlike equities, which may suffer from rapid price fluctuations, mortgage funds generally generate steady, asset-backed returns. However, they are not entirely risk-free, as economic shifts can still impact fund performance and borrower repayment capabilities. By strategically navigating economic cycles, Fidelis Private Fund provides investors with consistent income streams, capital preservation, and opportunities for long-term growth through expert underwriting and a commitment to transparency.

Looking Ahead: The Future of Private Lending

As economic cycles evolve, private lending is expected to play a growing role in real estate financing. Regulatory shifts, interest rate adjustments, and advancements in financial technology will further shape the industry, offering new opportunities for investors and borrowers alike. Those who understand the cyclical nature of mortgage fund yields will be best positioned to capitalize on emerging trends and secure sustainable returns.

Explore Smarter Lending Strategies with Fidelis Private Fund

At Fidelis Private Fund, we specialize in strategic, flexible lending solutions designed to perform in all market conditions. Call us today at 760-258-4486 to speak directly with our team and explore your investment options. Contact us today to learn how our mortgage funds have consistently delivered stable returns, even in fluctuating markets. With a track record of successful investments and a strategic risk mitigation approach, we provide solutions that empower investors to confidently navigate economic shifts.

Visit fidelispf.com or call us at 760-258-4486 to learn how Fidelis can help you achieve stability and consistent growth in your portfolio.

See Our Latest Performance Report

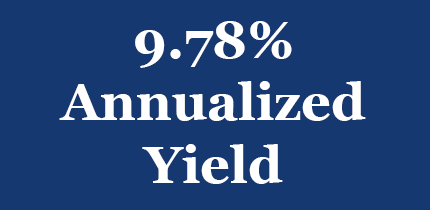

Fidelis Private Fund annualized yield paid to Limited Partners for the 1st Quarter 2025. Click here for a summary of Fidelis’s annualized yield since inception.

Fidelis Private Fund annualized yield paid to Limited Partners for the 1st Quarter 2025. Click here for a summary of Fidelis’s annualized yield since inception.

Fidelis 2028 Vivid Vision – Where are we going and how are we going to get there!

Fidelis 2028 Vivid Vision – Where are we going and how are we going to get there!

The Fidelis 2028 Vivid Vision document provides a comprehensive blueprint of the company’s strategic direction, core values, and operational principles, highlighting its commitment to capital preservation, growth, innovation, and client-centric services. Click to read the Fidelis vision.