Understanding the Urgency Behind Time-Sensitive Investment Opportunities

In the fast-paced world of real estate investment, the ability to act quickly can be the key to unlocking extraordinary returns. Yet, many investors find themselves hindered by one critical roadblock: conventional financing timelines. When opportunities arise that require action in days—not weeks or months—traditional lenders simply can’t keep up.

Imagine discovering a distressed multi-unit property in a rapidly appreciating neighborhood, offered at a steep discount due to the seller’s urgent need to liquidate. The potential upside is clear: finish the renovations, stabilize the property, and either refinance or sell at a profit. But there’s a catch—the deal requires a 10-day close. For most conventional lenders, that’s not just fast; it’s impossible.

This type of scenario is far from rare. In fact, it’s increasingly common in competitive markets where speed often dictates who secures the deal. Investors need funding solutions that match the pace of the market.

The Disconnect Between Traditional Financing and Investor Needs

Conventional lenders are built for stability, not speed. Their approval processes, documentation requirements, and internal hierarchies are designed to mitigate risk—especially for standard, owner-occupied properties. While this makes sense for long-term homebuyers, it doesn’t align with the needs of real estate entrepreneurs who thrive on agility and calculated risk.

Here are some common friction points:

- Long approval timelines: Traditional loans can take 45–60 days to close—far too slow for many distressed or below-market opportunities.

- Property condition issues: If a property is mid-renovation or needs significant repairs, institutional lenders often back away due to appraisal challenges or underwriting limitations.

- Debt-to-income ratios: Even experienced investors with solid track records can be declined if they carry multiple active loans, regardless of payment history.

Why Private Lending Offers a Competitive Edge

This is where private lenders like Fidelis Private Fund stand apart. Our model is designed specifically for situations that demand speed, flexibility, and a property-first approach.

Rather than scrutinizing every detail of a borrower’s financial life, our focus is on evaluating:

- The current and after-repair value of the property

- The investor’s business plan and exit strategy

- The feasibility and upside potential of the deal

This structure allows us to deliver approvals within a fraction of the time it takes conventional lenders. In many cases, funding can be secured in as little as 48 hours—empowering investors to make confident, timely offers.

Keys to Rapid Financing Success

To position yourself for fast funding, it helps to keep these best practices in mind:

- Build relationships before you need them: Establishing a connection with a responsive private lender before the deal arises means you won’t be scrambling when the right opportunity hits.

- Have your documents ready: Keeping basic business documents (like operating agreements and recent financials) organized can significantly reduce friction in the approval process.

- Clearly communicate urgency: The more specific and transparent you are about your timeline, the better a private lender can align their resources to meet your needs.

How Fidelis Supports Fast-Moving Investors

How Fidelis Supports Fast-Moving Investors

At Fidelis Private Fund, we’ve built our lending process to support experienced investors facing compressed timelines. Here’s how we help:

- Quick response times: We move with urgency when the opportunity warrants it—often issuing funding decisions within 48 hours.

- Property-first underwriting: We look at the real-world potential of the deal, not just traditional metrics.

- Streamlined documentation: Our paperwork is focused and relevant, so you can spend less time assembling documents and more time executing your strategy.

- Direct access to decision-makers: You’ll always know where your loan stands—no bureaucratic runaround, just clear answers.

Final Thought: Speed Creates Leverage

In today’s real estate market, the investor who moves fastest often wins. But speed without the right financial partner can lead to missed opportunities or unnecessary risk. That’s where Fidelis comes in.

If you’re evaluating a real estate investment that requires quick action—and traditional financing just won’t cut it—our team is ready to help. We specialize in rapid, reliable private lending for high-opportunity deals that can’t wait.

Let’s talk. Contact Fidelis Private Fund at 760-258-4486 to explore how our tailored approach can support your next investment.

Connect with our team today to learn more about our investment approach and how Fidelis can support your portfolio goals — with confidence and clarity.

📞 Call us at 760-258-4486

Explore how Fidelis can support your growth with flexible, fast financing solutions tailored to your needs.

See Our Latest Performance Report

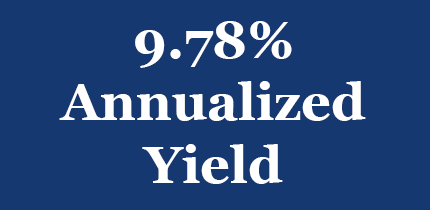

Fidelis Private Fund annualized yield paid to Limited Partners for the 1st Quarter 2025. Click here for a summary of Fidelis’s annualized yield since inception.

Fidelis Private Fund annualized yield paid to Limited Partners for the 1st Quarter 2025. Click here for a summary of Fidelis’s annualized yield since inception.

Fidelis 2028 Vivid Vision – Where are we going and how are we going to get there!

Fidelis 2028 Vivid Vision – Where are we going and how are we going to get there!

The Fidelis 2028 Vivid Vision document provides a comprehensive blueprint of the company’s strategic direction, core values, and operational principles, highlighting its commitment to capital preservation, growth, innovation, and client-centric services. Click to read the Fidelis vision.