For investors seeking stable income with strong capital preservation, understanding risk mitigation strategies represents a critical component of due diligence. Within private mortgage funds, loan-to-value (LTV) management stands as perhaps the single most important risk control mechanism, creating a fundamental protection layer that shields investor capital from potential market fluctuations and borrower challenges. This seemingly simple ratio—the percentage of a property’s value being financed—significantly influences both investment security and return potential.

While many investment vehicles employ complex risk management techniques that remain largely vague to investors, mortgage fund LTV strategies provide a refreshingly transparent and intuitive approach to capital protection. By understanding how experienced fund managers utilize LTV policies to balance risk and return, investors can more effectively evaluate different mortgage fund options while setting realistic expectations for both performance and security.

The Foundation: Understanding LTV Fundamentals

The loan-to-value ratio represents a fundamental risk metric in real estate lending:

- LTV calculation divides the loan amount by the property’s appraised value, expressed as a percentage. For example, a $650,000 loan secured by a $1,000,000 property represents a 65% LTV ratio, indicating that 35% of the property’s value remains as a protective equity cushion.

- Equity cushions provide the primary protection mechanism against potential fluctuations in value. This buffer must be completely eliminated before lender principal faces impairment, creating a significant safety margin when conservative LTV policies are employed.

- Risk correlation with LTV follows a non-linear relationship, with risk increasing disproportionately at higher LTV levels. The difference between 75% and 80% LTV represents a substantially larger risk increment than the difference between 60% and 65%, as the remaining equity buffer becomes increasingly thin.

Strategic LTV Management Across Property Types

Strategic LTV Management Across Property Types

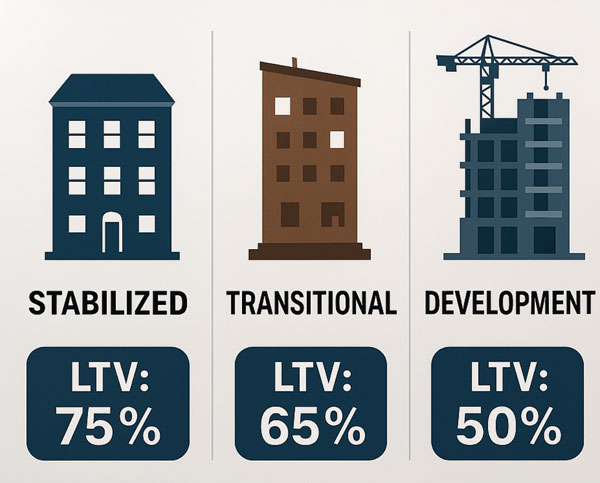

Sophisticated mortgage funds adjust LTV parameters based on property characteristics:

- Stabilized income properties with established cash flows typically qualify for higher LTV ratios due to their performance predictability and market liquidity. These properties often support LTVs in the 65-75% range while maintaining appropriate risk parameters.

- Transitional properties undergoing renovation or repositioning generally warrant more conservative LTVs to accommodate execution uncertainty and potential timeline extensions. These opportunities typically receive LTVs in the 60-65% range to provide additional protection during the improvement process.

- Development projects with construction components present the highest execution complexity and typically receive the most conservative LTVs, often 50-60% of completed value. These lower ratios account for both construction risk and market absorption uncertainty upon completion.

The Fidelis Private Fund Approach to LTV Management

Fidelis Private Fund has developed a disciplined LTV strategy designed to protect investor capital while maintaining attractive yields:

- We employ a tiered LTV approach that adjusts maximum ratios based on property type, location quality, borrower experience, and market conditions. This nuanced methodology creates appropriate protection layers for each specific opportunity rather than applying one-size-fits-all standards.

- Our underwriting focuses on sustainable value rather than temporary price surges, particularly during strong market cycles when appraisals might reflect peak conditions. This conservative approach provides additional security margins that help insulate the portfolio from potential market corrections. However, unlike many private lenders, Fidelis takes into account the strength of the borrower relationship. This intangible asset can reduce risk, which is not apparent in quantitative analysis, but can add considerable value (and security) to a transaction.

Beyond Simple Ratios: The Complete LTV Picture

Several factors beyond the basic LTV calculation influence actual risk profiles:

Several factors beyond the basic LTV calculation influence actual risk profiles:

- Valuation methodology significantly impacts effective LTV protection. Experienced managers employ conservative valuation approaches that consider both current market conditions and potential future scenarios rather than simply accepting the highest possible appraisal.

- Property liquidity directly affects the practical significance of LTV ratios. A 65% LTV on a highly liquid property type in a strong market provides more effective protection than the same ratio on a specialized property with limited buyer pools.

- Market trajectory influences how LTV protection evolves over time. In appreciating markets, LTV ratios naturally improve as property values increase, while declining markets can erode equity cushions if not properly anticipated through conservative initial ratios.

LTV as a Portfolio Management Tool

Beyond individual loan decisions, LTV strategies influence overall portfolio construction:

- Weighted average LTV across the entire portfolio provides a comprehensive risk metric that sophisticated investors evaluate when comparing different mortgage funds. This portfolio-level measure offers insights into overall risk positioning that individual loan examples cannot provide.

- LTV diversification through varied ratios across different loans creates natural risk tiering within portfolios. Rather than concentrating at maximum allowable ratios, well-managed funds typically maintain a distribution of LTVs that enhances overall stability.

- Counter-cyclical LTV adjustment—becoming more conservative during strong markets and potentially more aggressive during corrections—helps maintain consistent risk parameters across market cycles. This disciplined approach prevents the common mistake of relaxing standards during booming markets when competition increases.

The Relationship Between LTV and Returns

LTV policies directly influence the risk-return profile of mortgage investments:

- Yield correlation with LTV typically shows direct relationships, with higher LTV loans generally commanding higher interest rates to compensate for increased risk. This relationship creates natural risk-adjusted return considerations when constructing portfolios.

- Risk-adjusted returns often peak in the middle LTV ranges rather than at the highest possible ratios. The optimal balance typically occurs where additional yield no longer adequately compensates for incremental risk, usually in the 65-70% LTV range for most property types.

- Investor preferences regarding the risk-return spectrum influence appropriate fund selection. Some investors prioritize maximum security through lower portfolio LTVs with correspondingly lower yields, while others accept moderately higher LTVs to enhance returns while maintaining reasonable protection.

LTV During Market Stress: The Ultimate Test

LTV During Market Stress: The Ultimate Test

Historical performance during market corrections reveals the practical value of conservative LTV policies:

- Value decline absorption represents the primary function of equity cushions during market stress. A portfolio with a 65% weighted average LTV can theoretically withstand a 35% market correction before facing principal impairment, though individual loans may experience varied outcomes.

- Performance divergence between conservative and aggressive LTV portfolios becomes most apparent during significant corrections. While portfolios with 75-80% LTVs often experience material distress during 20-25% market declines, those maintaining 60-65% LTVs typically weather such corrections with minimal disruption.

- Recovery positioning after market stress creates additional advantages for conservative LTV portfolios. With fewer distressed assets requiring workout or foreclosure, these portfolios can maintain focus on new opportunities that often emerge during recovery phases rather than managing legacy problems.

Investor Due Diligence: Evaluating LTV Strategies

When assessing mortgage funds, several LTV-related factors merit particular attention:

- Historical LTV discipline through previous market cycles offers valuable insights into manager behavior under various conditions. Funds that maintain conservative approaches even during competitive markets typically demonstrate the discipline that enhances long-term performance stability. A key factor to consider is the manager’s track record and how they have managed the fund through various market cycles, which helps you understand the overall risk of the fund.

For investors seeking stable income with strong capital preservation, Fidelis Private Fund offers a professionally managed mortgage fund featuring disciplined loan-to-value (LTV) strategies designed to protect investor capital while delivering attractive yields. Contact us today at 760-258-4486 to learn more about our risk management approach and current opportunities.

Explore how Fidelis can support your growth with flexible, fast financing solutions tailored to your needs.

See Our Latest Performance Report

Fidelis Private Fund annualized yield paid to Limited Partners for the 1st Quarter 2025. Click here for a summary of Fidelis’s annualized yield since inception.

Fidelis Private Fund annualized yield paid to Limited Partners for the 1st Quarter 2025. Click here for a summary of Fidelis’s annualized yield since inception.

Fidelis 2028 Vivid Vision – Where are we going and how are we going to get there!

Fidelis 2028 Vivid Vision – Where are we going and how are we going to get there!

The Fidelis 2028 Vivid Vision document provides a comprehensive blueprint of the company’s strategic direction, core values, and operational principles, highlighting its commitment to capital preservation, growth, innovation, and client-centric services. Click to read the Fidelis vision.