Diversification is one of the most well-known tools for managing investment risk — yet many investors overlook how crucial it is within a specific fund, not just across asset classes. At Fidelis Private Fund, we believe that how a mortgage fund manages internal diversification can be just as important as where investors place their capital. Our approach is built not only on the principles of diversification but also on deep market insight, intentional strategy, and decades of local lending experience.

Understanding what drives internal fund stability helps investors make more informed decisions — and more importantly, choose a fund that aligns with their long-term goals for income and capital preservation.

Why Diversification Matters Within Mortgage Funds

Mortgage funds inherently carry risk. The key is managing that risk thoughtfully. Spreading capital across a variety of loans reduces the impact of any one loan experiencing difficulty. When thoughtfully applied, diversification enhances predictability, improves liquidity, and creates resilience within the fund.

At Fidelis, we look at diversification not as a box-checking exercise, but as a structural advantage. It’s how we build in stability for our investors — especially during economic volatility.

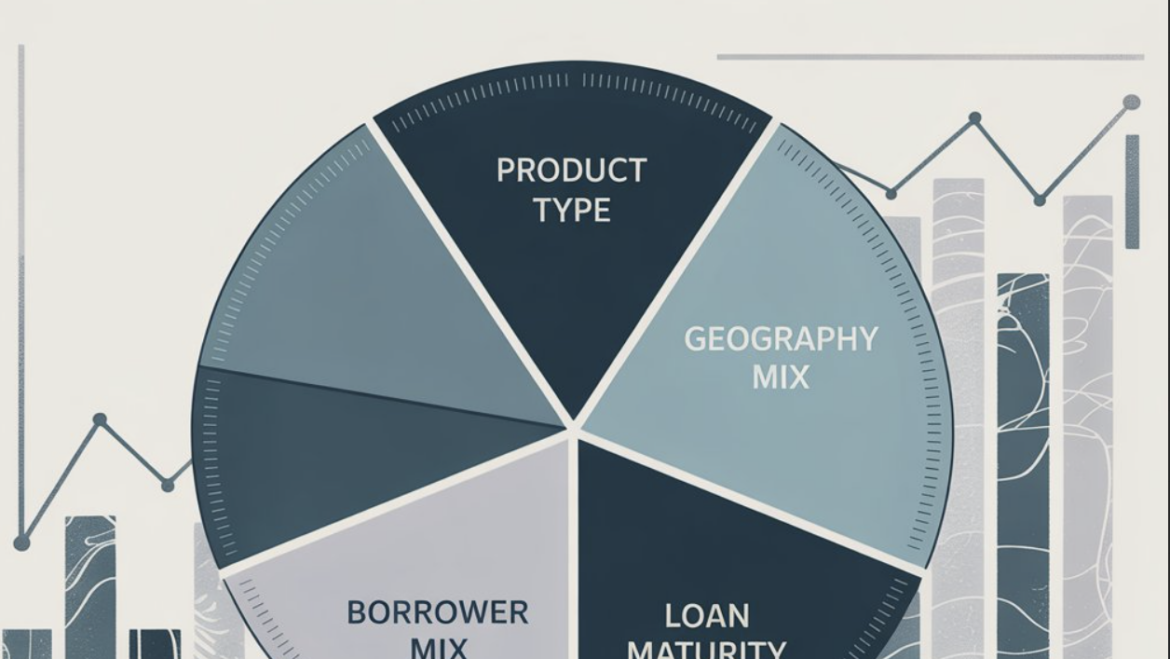

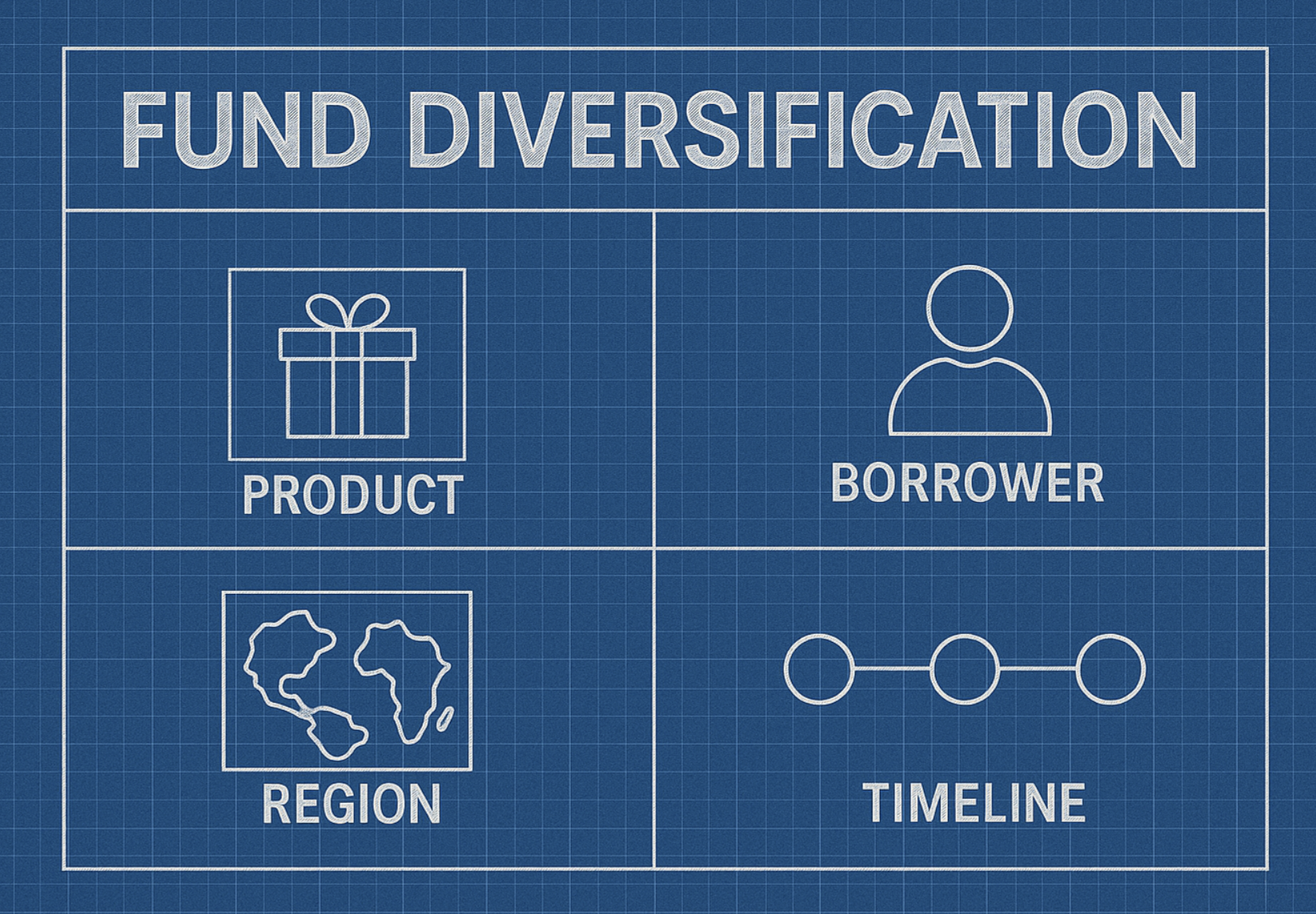

How Fidelis Approaches Diversification

Unlike some funds that take a generalized diversification approach, Fidelis uses a deliberate and research-driven strategy. Here’s how we structure our fund to support long-term investor confidence:

1. Product Diversification – Focused Where It Counts

We are diversified across loan types — but not for the sake of variety alone. Most of our lending is focused on residential and multifamily properties. Why? Because in the San Diego market, these asset types are historically the most resilient. They’re backed by consistent housing demand and low vacancy rates, which supports cash flow stability and borrower strength.

We are diversified across loan types — but not for the sake of variety alone. Most of our lending is focused on residential and multifamily properties. Why? Because in the San Diego market, these asset types are historically the most resilient. They’re backed by consistent housing demand and low vacancy rates, which supports cash flow stability and borrower strength.

By emphasizing the most stable property segments, we help insulate the fund from volatility while still delivering competitive returns.

2. Geographic Diversification – Deep Roots, Not Wide Reach

Unlike national funds that spread their exposure thinly across unfamiliar markets, we take a different approach. Fidelis is intentionally focused in the San Diego region. This isn’t a limitation — it’s a strength.

Our deep local knowledge allows us to underwrite with greater accuracy, anticipate shifts in demand, and cultivate long-standing relationships. While geographic diversification is a conventional risk strategy, we believe that depth of understanding within a market can often mitigate more risk than broad but shallow dispersion.

In fact, attempting to diversify geographically without nuanced market knowledge can introduce more risk, not less. At Fidelis, our strategy is to leverage what we know — and we know San Diego extremely well.

3. Loan Size and Borrower Diversification – Guardrails That Work

We structure our fund to avoid overexposure to any single loan or borrower. This includes strict caps on individual loan sizes and careful attention to borrower relationships. We do this not just to meet diversification metrics, but to actively reduce the potential for any single issue to ripple through the portfolio.

By keeping loan sizes balanced and working with a range of borrowers, we help maintain consistency — both in fund performance and in investor experience.

4. Staggered Maturities – Natural Liquidity, Reduced Risk

Our portfolio includes a mix of loan maturities, which helps ensure that capital returns gradually and predictably. This creates natural liquidity and lowers the reinvestment risk that can occur when too much capital returns at once during challenging market conditions.

We also benefit from “vintage diversification” — loans originated in different market cycles. This guards against overexposure to any single period of economic or interest rate conditions.

Why Fidelis’ Approach Matters to You

Investors looking for predictable income and long-term capital protection should examine more than just yield. How a fund diversifies — and more importantly, how it thinks about diversification — is a key indicator of how risks are managed.

At Fidelis Private Fund, diversification isn’t just about numbers. It’s about discipline, strategy, and deep market knowledge. We aim to provide investors with a well-constructed portfolio rooted in stability, not speculation.

If you’re seeking a mortgage fund that balances attractive returns with thoughtful risk management, we’d welcome a conversation.

Connect with our team today to learn more about our investment approach and how Fidelis can support your portfolio goals — with confidence and clarity.

📞 Call us at 760-258-4486

Explore how Fidelis can support your growth with flexible, fast financing solutions tailored to your needs.

See Our Latest Performance Report

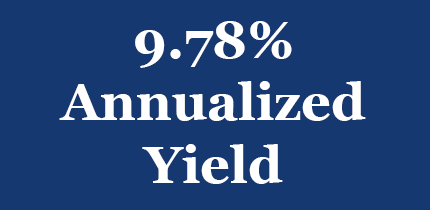

Fidelis Private Fund annualized yield paid to Limited Partners for the 1st Quarter 2025. Click here for a summary of Fidelis’s annualized yield since inception.

Fidelis Private Fund annualized yield paid to Limited Partners for the 1st Quarter 2025. Click here for a summary of Fidelis’s annualized yield since inception.

Fidelis 2028 Vivid Vision – Where are we going and how are we going to get there!

Fidelis 2028 Vivid Vision – Where are we going and how are we going to get there!

The Fidelis 2028 Vivid Vision document provides a comprehensive blueprint of the company’s strategic direction, core values, and operational principles, highlighting its commitment to capital preservation, growth, innovation, and client-centric services. Click to read the Fidelis vision.