Whether you’re a seasoned developer or a first-time investor, securing funding quickly and on your terms can be the difference between seizing a golden opportunity or watching it slip away. That’s where private lending shines. Unlike traditional bank loans, which often involve extensive documentation and approval processes, private lending offers the speed, flexibility, and strategic growth opportunities you need to stay ahead of the competition.

The Advantage of Speed: Time is Money in Real Estate

Traditional lenders, such as banks, often take weeks—or even months—to process loan applications. The extensive underwriting process, strict documentation requirements, and rigid approval criteria can cause frustrating delays that put your investment at risk.

In contrast, private lending is built for speed. With a streamlined underwriting process, loans can often be approved and funded in just days. Fidelis Private Fund, for instance, specializes in fast, common-sense financing, ensuring that borrowers can act quickly when an opportunity arises.

Why Speed Matters:

- Competitive Advantage: Properties in high-demand markets are sold quickly. Private lending allows you to move faster than competitors relying on traditional financing.

- Project Momentum: Faster funding means you can break ground sooner, keep projects on schedule, and meet deadlines.

- Seizing Value-Add Opportunities: Many distressed properties and off-market deals require fast closings—something banks simply can’t provide.

Flexibility: Tailored Loan Terms That Work for You

Flexibility: Tailored Loan Terms That Work for You

Banks operate with rigid guidelines, offering little room for customization. They have strict debt-to-income requirements, credit score minimums, and a one-size-fits-all loan structure. If your project falls outside their mold, you’re out of luck.

Private lenders, on the other hand, understand that every deal is unique. Fidelis Private Fund exemplifies this by offering tailored financing for projects that banks might overlook, such as ADU developments and value-add renovations, ensuring that investors have access to customized solutions that align with their project timelines and goals. At Fidelis, we craft creative financing solutions tailored to the specific needs of your investment. Whether it’s a construction loan, bridge loan, or value-add project financing, our terms are structured to align with your goals.

Benefits of Flexible Loan Terms:

- Custom Repayment Plans: Adjust payment structures to fit your cash flow cycle.

- Asset-Based Lending: Approval is focused on the value of the property, not just your personal credit history.

- Bridge Loans for Short-Term Needs: Perfect for investors needing quick capital while waiting for long-term financing or a property sale.

Strategic Growth: Leveraging Private Lending to Scale Your Portfolio

For developers and investors looking to grow their portfolios, access to consistent and reliable funding is crucial. Traditional lenders often cap the number of loans they’ll issue, limiting your ability to scale. Fidelis Private Fund supports real estate investors in scaling their portfolios by providing consistent access to capital, empowering repeat borrowers with a streamlined funding process that removes unnecessary delays and restrictions. Private lenders like Fidelis work with investors long-term, providing repeat borrowers with pre-approved capital and a seamless funding process.

How Private Lending Fuels Growth:

- Funding More Deals: With faster access to capital, you can acquire more properties and expand your portfolio.

- Streamlined Process: Skip the exhaustive paperwork and strict credit requirements that banks impose.

- Stronger Investment Strategies: Private lending allows for creative financing strategies, including fix-and-flips, ground-up construction, and multifamily development.

Why Investors Choose Fidelis Private Fund

At Fidelis Private Fund, we specialize in providing real estate investors with fast, flexible, and common-sense financing solutions. Our relationship-driven approach ensures that each borrower gets personalized attention and loan structures that make sense for their projects.

What Sets Fidelis Apart:

- Quick Approvals & Funding: Often within days, not weeks.

- Customized Loan Structures: Tailored to your investment goals.

- Relationship-Based Lending: Long-term partnerships, not just transactions.

- Transparent & Reliable: We ensure full transparency with a clear breakdown of fees and upfront disclosures to eliminate unexpected costs.

Ready to Fund Your Next Real Estate Deal?

Don’t let slow, inflexible financing hold you back. Whether you need funding for a new acquisition, a rehab project, or a bridge loan to keep your momentum going, Fidelis Private Fund is here to help.

For personalized guidance, connect with our team today. Call Fidelis Private Fund now at 760-258-4486 and schedule a meeting with our experts to discuss your investment goals. Our experienced team has helped countless investors navigate market uncertainty and build resilient portfolios with confidence. Let’s build a resilient financial future together.

Let’s build a resilient financial future together.

Visit fidelispf.com or call us at 760-258-4486 to learn how Fidelis can help you achieve stability and consistent growth in your portfolio.

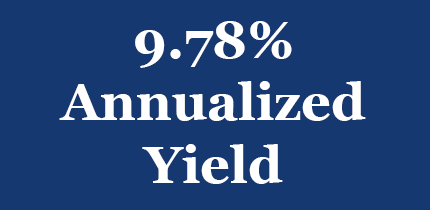

See Our Latest Performance Report

Fidelis Private Fund annualized yield paid to Limited Partners for the 1st Quarter 2025. Click here for a summary of Fidelis’s annualized yield since inception.

Fidelis Private Fund annualized yield paid to Limited Partners for the 1st Quarter 2025. Click here for a summary of Fidelis’s annualized yield since inception.

Fidelis 2028 Vivid Vision – Where are we going and how are we going to get there!

Fidelis 2028 Vivid Vision – Where are we going and how are we going to get there!

The Fidelis 2028 Vivid Vision document provides a comprehensive blueprint of the company’s strategic direction, core values, and operational principles, highlighting its commitment to capital preservation, growth, innovation, and client-centric services. Click to read the Fidelis vision.