Understanding the Relationship Between Inflation and Private Lending

Inflation influences nearly every sector of the economy, and private lending is no exception. As the cost of goods and services rises, so do interest rates, borrowing costs, and overall investment dynamics. For private lenders and investors, understanding these shifts is crucial for making informed decisions and safeguarding capital. Fidelis Private Fund has been at the forefront of helping investors navigate these changes with strategic lending solutions.

The Impact of Inflation on Private Lending

1. Rising Interest Rates and Loan Costs

Inflation often prompts central banks to raise interest rates to curb excessive price growth. As rates climb, the cost of borrowing increases, affecting real estate developers and investors reliant on private loans. Higher interest rates mean:

- More expensive financing for borrowers.

- Greater returns for lenders due to higher yields on new loans.

- Potential slowdown in deal flow, as some investors hesitate to take on higher-cost debt.

2. Increased Demand for Private Capital

Traditional banks often tighten lending criteria in response to inflation, making it harder for businesses and real estate investors to secure funding. This shift creates an opportunity for private lenders like Fidelis Private Fund to fill the financing gap. Investors should anticipate:

- Stronger demand for private mortgage funds and alternative lending solutions.

- A more dynamic lending environment, where private lenders can offer tailored solutions that benefit both the borrower and lender.

- Higher-quality lending opportunities, as only the strongest projects can sustain increased costs.

3. Asset Value Fluctuations

Inflation affects real estate values in both positive and negative ways. While rising construction costs and supply chain disruptions may increase property values, higher borrowing costs can reduce affordability and transaction volume. Investors should watch for:

- Stronger appreciation in markets with high demand and limited supply.

- Potential volatility in markets where affordability challenges reduce buyer interest.

- More strategic underwriting, focusing on asset quality and long-term value preservation.

Strategies for Private Lending Investors During Inflation

1. Prioritize Low Loan-to-Value (LTV) Loans

In an inflationary environment, lower LTV loans reduce risk by ensuring a larger equity cushion. Private lenders should focus on well-capitalized borrowers and properties with strong fundamentals. Fidelis Private Fund employs a disciplined approach to underwriting, ensuring risk is managed effectively.

2. Adjust Loan Pricing to Reflect Market Conditions

To stay competitive and profitable, lenders must align interest rates with inflation trends. Implementing adjustable-rate loans or shorter loan durations can help manage risk while capturing higher returns. Fidelis’s loans are bridge loans and rollover within 1-2 years, and reflect the market as a hedge against inflation.

3. Diversify Loan Portfolios

A balanced mix of loan types—residential, commercial, and development—can help mitigate risk exposure. Diversification ensures stability even if certain sectors experience temporary downturns.

4. Stay Ahead of Market Trends

Private lending success hinges on proactive strategy and market awareness. Investors should regularly analyze:

- Federal Reserve policies and inflation forecasts.

- Regional real estate trends and borrower demand shifts.

- The evolving competitive landscape of private lending.

Looking Ahead: The Future of Private Lending in an Inflationary Market

While inflation presents challenges, it also creates new opportunities for private lenders and investors. Those who remain adaptable, focus on risk management, and leverage strategic lending practices will be well-positioned to thrive.

Take the Next Step

Looking to refine your investment strategy during uncertain economic times? Reach out to Fidelis Private Fund today to learn how our expert team stands apart from competitors with flexible, transparent, and customized private lending solutions. With a track record of helping investors navigate complex market conditions, Fidelis is your trusted partner in private lending. Call us at 760-258-4486 to discuss how we can help you maximize returns and manage risk with confidence.

External Links:

Visit fidelispf.com or call us at 760-258-4486 to learn how Fidelis can help you achieve stability and consistent growth in your portfolio.

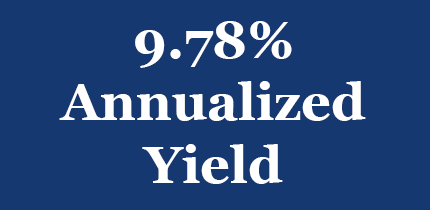

See Our Latest Performance Report

Fidelis Private Fund annualized yield paid to Limited Partners for the 1st Quarter 2025. Click here for a summary of Fidelis’s annualized yield since inception.

Fidelis Private Fund annualized yield paid to Limited Partners for the 1st Quarter 2025. Click here for a summary of Fidelis’s annualized yield since inception.

Fidelis 2028 Vivid Vision – Where are we going and how are we going to get there!

Fidelis 2028 Vivid Vision – Where are we going and how are we going to get there!

The Fidelis 2028 Vivid Vision document provides a comprehensive blueprint of the company’s strategic direction, core values, and operational principles, highlighting its commitment to capital preservation, growth, innovation, and client-centric services. Click to read the Fidelis vision.