Understanding the Relationship Between Interest Rates and Mortgage Funds

Interest rates play a pivotal role in shaping the performance of mortgage funds. As economic conditions fluctuate, central banks adjust rates to either stimulate growth or control inflation. For mortgage fund investors, these rate changes can impact returns, risk levels, and borrowing demand in significant ways.

The Effect of Rising Interest Rates on Mortgage Funds

1. Higher Borrowing Costs

When interest rates rise, borrowing becomes more expensive. This affects developers and property investors who rely on short-term lending solutions. Fidelis Private Fund and other mortgage funds may see a slowdown in new loan originations as some borrowers reconsider their financing options, potentially impacting fund growth while maintaining stable returns due to existing loan agreements.

2. Improved Yield Potential for Investors

Higher rates generally mean higher loan interest rates, which can lead to increased returns for investors in mortgage funds. Well-managed funds with short-duration loans can adjust quickly to rate hikes, allowing investors to benefit from improved yields.

3. Market Liquidity and Default Risk

As borrowing costs rise, financially strained borrowers may struggle with repayment, potentially increasing loan defaults. Mortgage funds with strong underwriting standards, including thorough borrower vetting, detailed property appraisals, and conservative debt coverage ratios, along with conservative loan-to-value (LTV) ratios, can mitigate this risk, ensuring capital preservation for investors.

The Effect of Lower Interest Rates on Mortgage Funds

1. Increased Borrower Demand

When interest rates decline, borrowing becomes more attractive. Real estate investors and developers may rush to secure financing, leading to higher loan origination volumes for mortgage funds. This can drive fund growth and stability.

2. Compression of Yields

Lower interest rates can reduce the spread between borrowing costs and the returns offered by mortgage funds. Investors seeking higher fixed income alternatives may need to adjust expectations by either accepting lower returns in a low-rate environment or exploring funds with a diversified loan portfolio that balances risk and yield to maintain optimal returns.

3. Asset Value Appreciation

Lower rates often correlate with rising real estate values. This benefits mortgage funds with a strong portfolio of real estate-secured loans, as higher property values enhance collateral security and reduce default risks.

Strategies for Mortgage Fund Investors in Changing Rate Environments

Strategies for Mortgage Fund Investors in Changing Rate Environments

1. Focus on Funds with Adaptive Loan Structures

Mortgage funds, such as Fidelis Private Fund, actively monitor economic conditions and adjust interest rates accordingly, ensuring borrowers receive competitive financing options while safeguarding investor returns.

2. Diversify Across Loan Types and Markets

Fidelis Private Fund maintains a diversified mortgage fund portfolio—spanning short-term bridge loans, value-add projects, and stabilized asset financing—to reduce risk exposure to rate volatility and provide consistent opportunities for both investors and borrowers.

3. Monitor Loan-to-Value (LTV) Ratios

Investing in funds with conservative LTV ratios ensures protection against potential downturns, preserving capital while still generating competitive returns.

Final Thoughts

Interest rate fluctuations are a natural part of the economic cycle, but mortgage funds remain a strategic investment vehicle for those seeking stable, asset-backed returns. Investors who understand how these rate changes impact mortgage fund performance can make informed decisions to optimize their portfolios.

Next Steps: Explore Strategic Mortgage Fund Investments

If you’re interested in learning how mortgage funds can fit into your portfolio, call Fidelis Private Fund today at 760-258-4486 and speak with our expert team—a trusted partner known for its transparency, expertise, and commitment to delivering reliable returns. to explore tailored investment opportunities. For more insights, check out our real estate investment blog or visit our mortgage fund performance page.

External Resources:

Visit fidelispf.com or call us at 760-258-4486 to learn how Fidelis can help you achieve stability and consistent growth in your portfolio.

See Our Latest Performance Report

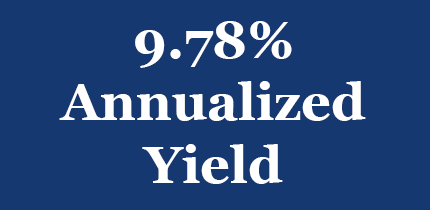

Fidelis Private Fund annualized yield paid to Limited Partners for the 1st Quarter 2025. Click here for a summary of Fidelis’s annualized yield since inception.

Fidelis Private Fund annualized yield paid to Limited Partners for the 1st Quarter 2025. Click here for a summary of Fidelis’s annualized yield since inception.

Fidelis 2028 Vivid Vision – Where are we going and how are we going to get there!

Fidelis 2028 Vivid Vision – Where are we going and how are we going to get there!

The Fidelis 2028 Vivid Vision document provides a comprehensive blueprint of the company’s strategic direction, core values, and operational principles, highlighting its commitment to capital preservation, growth, innovation, and client-centric services. Click to read the Fidelis vision.