Understanding Real Estate Debt and Equity Investments

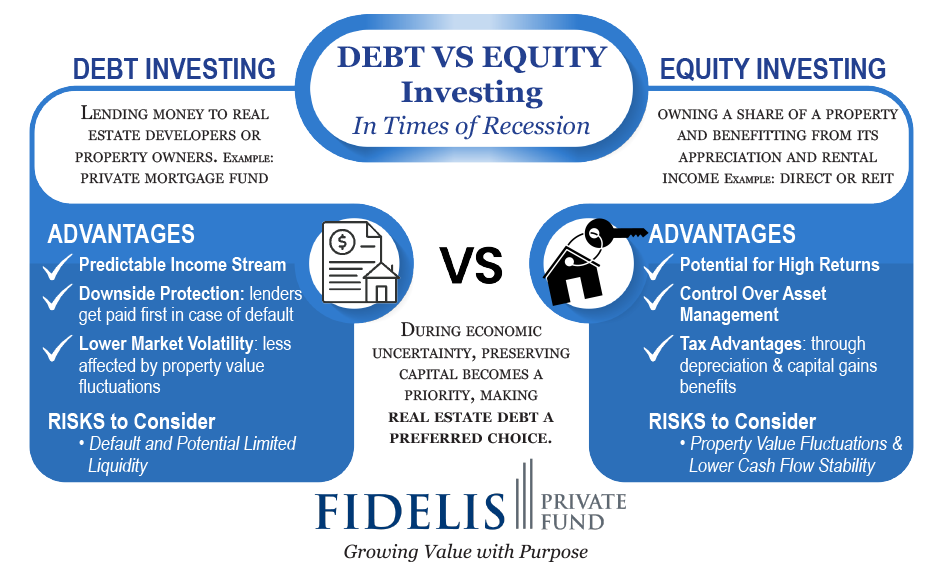

Real estate investors often debate whether debt or equity investments offer better stability, particularly during economic downturns. Each strategy presents unique advantages and risks, making understanding how they perform in recessionary environments crucial.

What is Real Estate Debt Investing?

Debt investing involves lending money to real estate developers or property owners in exchange for interest payments and principal repayment. This is typically done through private mortgage funds, real estate debt funds, or direct lending structures like those managed by Fidelis Private Fund.

Benefits of Real Estate Debt Investments in a Recession:

- Predictable Income: Investors receive fixed returns through interest payments, making it a reliable income stream.

- Downside Protection: Since debt investors hold a senior position in the capital stack, they are repaid before equity holders if a property is sold.

- Lower Market Volatility: Unlike equity investments, debt investments are less affected by property value fluctuations.

How Fidelis Private Fund Supports Debt Investors:

- Tailored Loan Structures: Fidelis customizes lending solutions to align with investor needs, focusing on secured real estate assets with strong repayment potential.

- Fast, Reliable Underwriting: Our streamlined underwriting process ensures quick funding decisions, allowing investors to confidently capitalize on opportunities.

- Capital Preservation Focus: With a disciplined approach to risk management, Fidelis prioritizes low loan-to-value (LTV) ratios and high-quality collateral to protect investor capital.

Risks to Consider

Default Risk: Borrowers may struggle to meet payments in prolonged downturns.

Liquidity Concerns: Some debt instruments may have lock-up periods, limiting quick exits.

What is Real Estate Equity Investing?

Equity investing means owning a share of the property and participating in its appreciation and rental income. Investors typically engage in REITs (Real Estate Investment Trusts), syndications, or direct property ownership. Fidelis understands the dynamics of equity investing and provides insights to help investors navigate both strategies.

Benefits of Real Estate Equity Investments in a Recession:

- Potential for High Returns: Equity investors benefit from property appreciation and increasing rental yields in long-term recoveries.

- Control Over Asset Management: Investors can influence operations, repositioning, and property strategy to mitigate risks.

- Tax Advantages: Equity investments often provide tax benefits through depreciation and capital gains treatments.

How Fidelis Private Fund Supports Equity Investors:

- Market Insights & Strategic Guidance: Fidelis provides expert market analysis to help investors identify high-value equity opportunities.

- Access to Exclusive Projects: Investors can participate in unique, well-structured deals through Fidelis’s network of developers and property owners.

- Flexible Investment Options: Our diverse portfolio includes a range of real estate opportunities, from stabilized income properties to value-add projects.

Risks to Consider:

Market Volatility: Property values fluctuate, impacting potential returns.

Lower Cash Flow Stability: Rental income may decline if vacancies rise or tenants default during a downturn.

Which Strategy Thrives in a Recession? Why Debt Investments Hold Strong

During economic uncertainty, preserving capital becomes a priority, making real estate debt a preferred choice. Since debt investments focus on fixed returns rather than property appreciation, investors gain stability, reduced risk, and predictable income even whenproperty values decline. Fidelis Private Fund offers structured lending solutions tailored for these economic conditions.

When Equity Investments Make Sense

Equity investments shine in long-term recoveries but may suffer in the short term. However, well-positioned equity deals—particularly those with strong cash flows and recession-resistant tenants—can present high-reward opportunities for risk-tolerant investors.

The Balanced Approach: Blending Debt and Equity

Savvy investors often diversify across both debt and equity, capitalizing on the stability of debt investments while leveraging equity for long-term growth. A well-structured portfolio that balances secured lending with strategic property ownership can hedge against recession risks while positioning for future gains. Fidelis Private Fund provides guidance on structuring investments that align with these principles.

Final Thoughts: Making the Right Choice

Choosing between real estate debt and equity investing depends on an investor’s risk tolerance, time horizon, and income needs. In uncertain economic times, debt investments provide security and steady returns, while equity investments require patience but offer significant upside potential in a recovery. Explore Secure and Strategic Real Estate Investment Opportunities with Fidelis Private Fund

At Fidelis Private Fund, we specialize in structured real estate debt investments that offer stable, low-risk returns while ensuring flexibility and security. Whether you seek predictable income through debt investments or long-term equity growth, Fidelis provides the expertise, market insights, and tailored solutions to help you succeed. Connect with us today to learn how our private mortgage fund can help you achieve your financial goals. Call us at 760-258-4486 to speak with our expert team and explore the best investment options for your portfolio. Learn more today

Let’s build a resilient financial future together.

Visit fidelispf.com or call us at 760-258-4486 to learn how Fidelis can help you achieve stability and consistent growth in your portfolio.

See Our Latest Performance Report

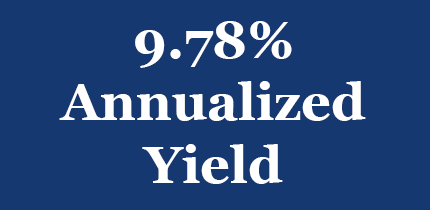

Fidelis Private Fund annualized yield paid to Limited Partners for the 1st Quarter 2025. Click here for a summary of Fidelis’s annualized yield since inception.

Fidelis Private Fund annualized yield paid to Limited Partners for the 1st Quarter 2025. Click here for a summary of Fidelis’s annualized yield since inception.

Fidelis 2028 Vivid Vision – Where are we going and how are we going to get there!

Fidelis 2028 Vivid Vision – Where are we going and how are we going to get there!

The Fidelis 2028 Vivid Vision document provides a comprehensive blueprint of the company’s strategic direction, core values, and operational principles, highlighting its commitment to capital preservation, growth, innovation, and client-centric services. Click to read the Fidelis vision.