How Bridge Loans Help You Secure Profitable Deals Before They Slip Away

In the context of real estate investment, speed and flexibility are crucial for securing profitable opportunities before they disappear. Traditional financing options, such as bank loans, are often bogged down by lengthy approval processes and rigid requirements. This is where private lending, specifically bridge loans, steps in as a powerful tool for real estate developers and investors looking to move quickly.

In the context of real estate investment, speed and flexibility are crucial for securing profitable opportunities before they disappear. Traditional financing options, such as bank loans, are often bogged down by lengthy approval processes and rigid requirements. This is where private lending, specifically bridge loans, steps in as a powerful tool for real estate developers and investors looking to move quickly.The Pitfalls of Traditional Loans

Traditional financing through banks comes with a series of challenges that can hinder an investor’s ability to close on lucrative deals. These obstacles include:

- Lengthy Approval Process: Banks require extensive documentation, appraisals, and underwriting, which can take weeks or even months.

- Strict Qualification Criteria: Conventional lenders have rigid lending criteria that may disqualify promising projects due to credit score issues, cash flow concerns, or property condition.

- Lack of Flexibility: Traditional loans often don’t account for the fast-moving nature of real estate deals, leading to missed opportunities.

For investors and developers who need quick access to capital, these challenges can be deal-breakers. That’s where bridge loans from private lenders like Fidelis Private Fund come into play.

The Advantages of Private Lending and Bridge Loans

Bridge loans are short-term financing solutions designed to “bridge the gap” between acquiring a property and securing long-term financing or selling the asset. Here’s why they are a game-changer for investors:

Bridge loans are short-term financing solutions designed to “bridge the gap” between acquiring a property and securing long-term financing or selling the asset. Here’s why they are a game-changer for investors:- Speed and Efficiency

Unlike traditional lenders, private lenders like Fidelis Private Fund can process and fund loans in a matter of days. This quick turnaround allows investors to capitalize on time-sensitive opportunities without delays. - Flexibility in Approval

Private lending is not restricted by the same stringent criteria as banks. Instead of focusing solely on credit scores and lengthy financial histories, Fidelis evaluates deals based on asset value, project viability, and borrower experience to ensure responsible lending while maintaining flexibility. Fidelis evaluates deals based on their potential profitability, asset value, and borrower experience rather than just a credit score. - Tailored Financing Solutions

Fidelis provides customized loan structures to align with the specific needs of developers and investors. Whether it’s a short-term fix-and-flip, a value-add property, or a commercial investment, our bridge loans offer flexible terms designed to fit your project’s requirements. - Less Bureaucracy, More Opportunity

With private lending, there’s no waiting for corporate approvals or dealing with excessive red tape. Fidelis prioritizes relationship-driven lending, ensuring smooth and transparent financing experiences that help investors scale their portfolios without the usual hurdles.

Why Investors Choose Fidelis Private Fund

At Fidelis, we understand that real estate success depends on seizing the right opportunity at the right time. Our bridge loans are designed to give investors the competitive edge they need to close deals with confidence.

-

Fast, reliable funding to prevent missed opportunities.

-

Flexible underwriting tailored to your project’s potential, not just financial statements.

-

Transparent loan terms that ensure clarity and ease of execution.

-

Long-term partnership focus, supporting repeat borrowers with pre-approved capital.

Secure Your Next Investment with Confidence

The real estate market waits for no one. If you’re ready to accelerate your investments and secure profitable deals with speed and flexibility, it’s time to explore private lending with Fidelis Private Fund.

For personalized guidance, connect with our team today. Call Fidelis Private Fund now at 760-258-4486 to schedule a meeting with our experts. Our experienced team has helped countless investors navigate market uncertainty and build resilient portfolios with confidence. Let us guide you toward a secure and profitable investment future.

Let’s build a resilient financial future together.

Visit fidelispf.com or call us at 760-258-4486 to learn how Fidelis can help you achieve stability and consistent growth in your portfolio.

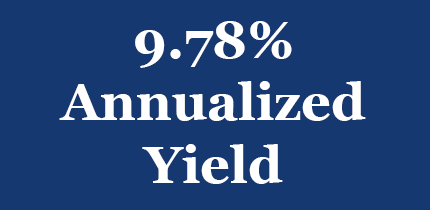

See Our Latest Performance Report

Fidelis Private Fund annualized yield paid to Limited Partners for the 1st Quarter 2025. Click here for a summary of Fidelis’s annualized yield since inception.

Fidelis Private Fund annualized yield paid to Limited Partners for the 1st Quarter 2025. Click here for a summary of Fidelis’s annualized yield since inception.

Fidelis 2028 Vivid Vision – Where are we going and how are we going to get there!

Fidelis 2028 Vivid Vision – Where are we going and how are we going to get there!

The Fidelis 2028 Vivid Vision document provides a comprehensive blueprint of the company’s strategic direction, core values, and operational principles, highlighting its commitment to capital preservation, growth, innovation, and client-centric services. Click to read the Fidelis vision.