Real estate development moves fast, and in a competitive market, securing financing quickly can make or break a deal. Traditional bank loans, while offering lower interest rates, often come with long approval timelines, rigid underwriting, and excessive documentation requirements. That’s why an increasing number of real estate developers are turning to private lending as a superior alternative for funding their projects.

At Fidelis Private Fund, we understand that speed, flexibility, and strategic financing are essential for developers looking to seize investment opportunities without delays. Here’s why private lending is becoming the preferred choice over conventional bank loans.

1. Speed: Time is Money in Real Estate

One of the biggest frustrations with bank loans is the time it takes to get approved and funded. Developers often face lengthy approval processes that can stretch from several weeks to months, causing them to miss out on lucrative deals.

Private lenders like Fidelis Private Fund specialize in rapid approvals. Our streamlined underwriting process ensures funding decisions in days—not weeks—allowing developers to close deals quickly and move forward with confidence.

2. Flexibility: Custom Financing Solutions

Banks have rigid lending criteria, requiring high credit scores, extensive paperwork, and strict income verification. Many developers with strong project plans still struggle to qualify under these restrictive conditions.

Private lenders offer a common-sense approach to underwriting. Instead of relying solely on credit scores, Fidelis evaluates the potential of the investment itself—assessing the property’s value, the developer’s experience, and the project’s feasibility. This means customized loan structures that align with your goals, whether it’s a bridge loan, construction financing, or value-add project funding.

3. Strategic Growth: Unlock More Opportunities

Some developers who rely on bank loans encounter lending limits that cap their ability to scale. Traditional lenders frequently refuse to finance multiple projects simultaneously, forcing developers to slow their growth.

With Fidelis Private Fund, developers can access capital without restrictive lending ceilings. We work with repeat borrowers to provide pre-approved capital, ensuring they can act swiftly on investment opportunities as they arise.

Why Developers Trust Fidelis Private Fund

We are committed to providing real estate developers with the tools they need to succeed through transparent, fast, and flexible lending solutions. Our clients choose us because we:

- Approve loans quickly with a straightforward underwriting process

- Offer customized financing based on project potential, not rigid banking requirements

- Provide repeat borrowers with strategic capital access to support long-term growth

- Maintain a relationship-driven approach to lending, ensuring ongoing support

Take the Next Step with Fidelis Private Fund

If traditional bank loans are slowing down your real estate growth, it’s time to explore a smarter financing option. Let Fidelis Private Fund be your trusted partner in achieving success through speed, flexibility, and strategic lending.

📞 Call Fidelis Private Fund now at 760-258-4486 to schedule a consultation with our experts.

Explore how Fidelis can support your growth with flexible, fast financing solutions tailored to your needs.

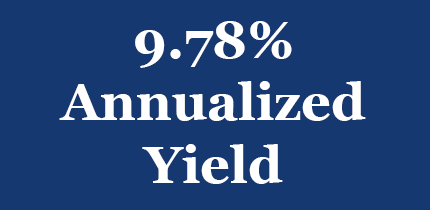

See Our Latest Performance Report

Fidelis Private Fund annualized yield paid to Limited Partners for the 1st Quarter 2025. Click here for a summary of Fidelis’s annualized yield since inception.

Fidelis Private Fund annualized yield paid to Limited Partners for the 1st Quarter 2025. Click here for a summary of Fidelis’s annualized yield since inception.

Fidelis 2028 Vivid Vision – Where are we going and how are we going to get there!

Fidelis 2028 Vivid Vision – Where are we going and how are we going to get there!

The Fidelis 2028 Vivid Vision document provides a comprehensive blueprint of the company’s strategic direction, core values, and operational principles, highlighting its commitment to capital preservation, growth, innovation, and client-centric services. Click to read the Fidelis vision.