As an investor, diversification is key to managing risk and maximizing returns over the long term. This is especially true when investing in a mortgage fund like Fidelis Private Fund.

With an understanding of the market, the Fidelis team strategically builds a diversified portfolio. The fund invests in various property types, including commercial, multi-family, residential investment properties, and even some land on an exception basis. This range of exposure, guided by our expertise, helps mitigate the impact of any one sector experiencing a downturn.

Moreover, by crafting a portfolio that includes a mix of bridge loans, construction financing, and mostly first trust deeds, Fidelis diversifies not only by property type but also by loan type, further solidifying the fund’s position against market volatility. This diversified approach underpins Fidelis’s ability to offer investors a blend of liquidity and long-term growth, compounding monthly interest or providing quarterly payouts with excellent yields.

By tactically allocating capital across property types and borrower profiles, Fidelis’ mortgage portfolio generates consistent income for investors while preserving our investors’ hard-earned capital. It’s the power of diversification in action.

As you consider your investment options, look for managers like Fidelis who make diversification a cornerstone of their strategy. It’s a proven approach for building wealth over time.

Next week, I will summarize in more detail how Fidelis strategically implements diversification to maximize investment returns and preserve investor capital.

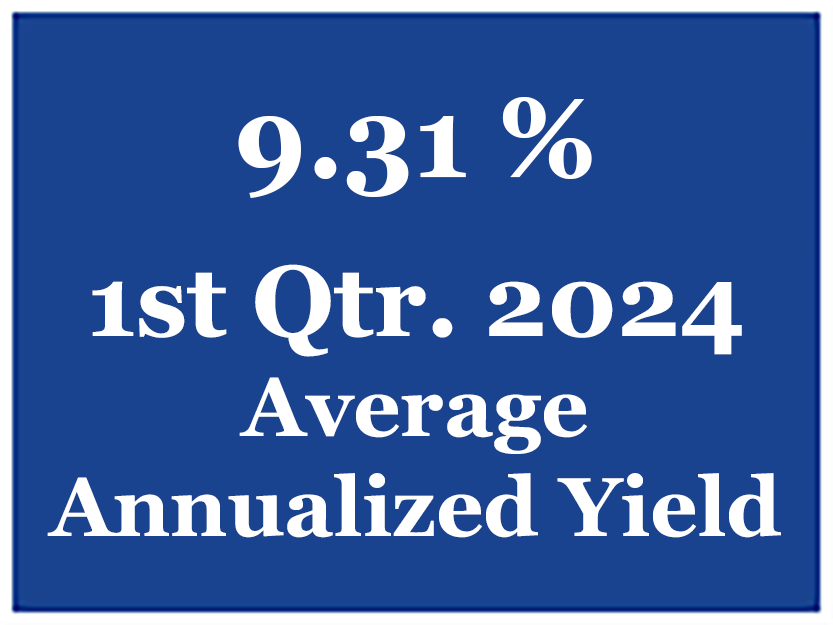

Fidelis Private Fund annualized yield paid to Limited Partners for the first quarter of 2024 was 9.31%. Click here for a summary of Fidelis’s annualized yield since inception.

Fidelis Private Fund annualized yield paid to Limited Partners for the first quarter of 2024 was 9.31%. Click here for a summary of Fidelis’s annualized yield since inception.

Fidelis 2028 Vivid Vision – Where are we going and how are we going to get there!

Fidelis 2028 Vivid Vision – Where are we going and how are we going to get there!

The Fidelis 2028 Vivid Vision document provides a comprehensive blueprint of the company’s strategic direction, core values, and operational principles, highlighting its commitment to capital preservation, growth, innovation, and client-centric services. Click to read the Fidelis vision.