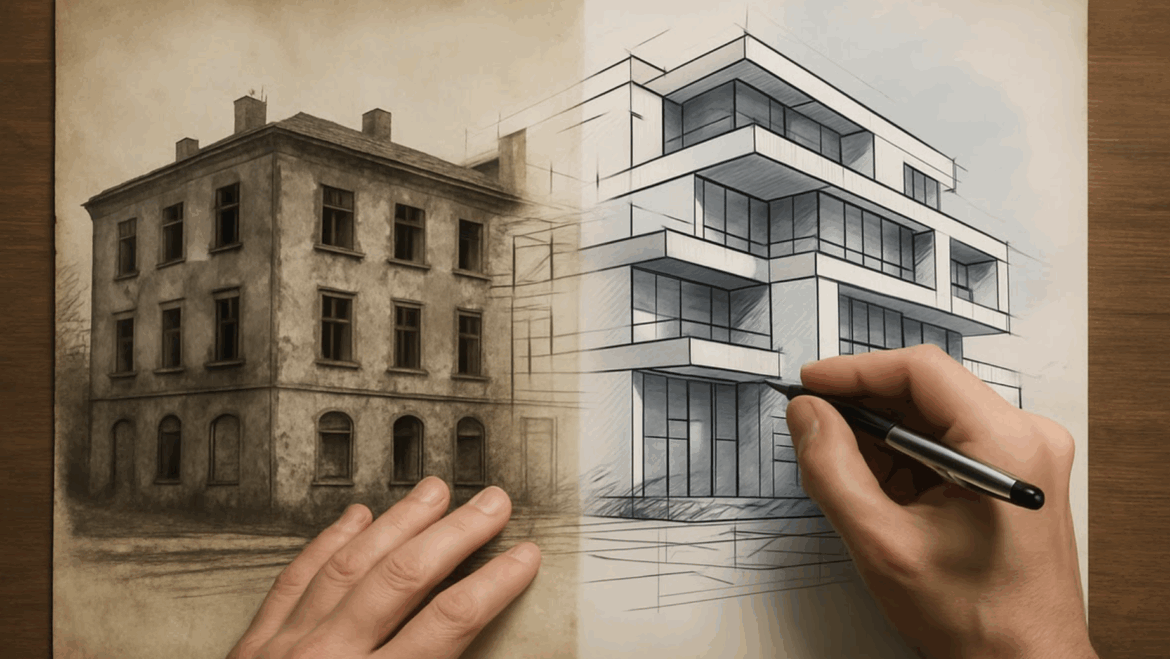

Turning an underutilized property into a vibrant, income-generating asset is one of the most impactful transformations in real estate. Whether it’s converting a low-density building into a multifamily residence or repositioning an outdated structure for modern use, these projects require vision—and financing that evolves with every phase of development.

At Fidelis Private Fund, we specialize in supporting this kind of value-add transformation. While ground-up construction is part of what we do, our primary focus lies in helping borrowers unlock the potential of existing properties by funding construction that enhances density, utility, and long-term value. This is where flexible, private lending makes a difference—and where Fidelis becomes more than just a lender. We become a strategic partner.

Meeting the Unique Financial Rhythm of Value-Add Development

Real estate projects that involve construction or repositioning follow a non-linear path. Each phase—acquisition, entitlement, and construction—has its own capital requirements and timing challenges. Unlike traditional financing that may only serve stabilized properties, value-add development demands responsiveness and adaptability.

At Fidelis, we align our financing with the natural lifecycle of these projects, offering support precisely when and how it’s needed.

How Fidelis Helps You Add Value Every Step of the Way

Our lending model is designed for borrowers seeking to bring new life to overlooked or underperforming properties. From initial acquisition to final construction, we provide the kind of flexible capital that allows you to move quickly and confidently.

1. Strategic Acquisition Financing

Whether acquiring a lot or an improved property with future upside, Fidelis offers early-stage capital to help secure the asset. We prioritize opportunities where value can be added through thoughtful redevelopment or repurposing.

2. Entitlement & Pre-Development Support

Even before construction begins, rezoning, permitting, and design work can significantly increase a property’s value. Our bridge financing allows borrowers to pursue these activities without sacrificing momentum or capital reserves.

3. Construction Lending That Moves With You

Construction projects evolve—and so should your financing. We provide structures that can adapt to job site changes, phasing requirements, and pacing shifts, all while staying in sync with your goals.

Why Developers Choose Fidelis

We aren’t just providing capital—we’re investing in possibilities. What sets Fidelis apart is our deep understanding of the development process, from entitlement hurdles to construction logistics. We combine real-world experience with a flexible underwriting approach that respects both numbers and vision.

We offer:

- Financing structures that match each phase of the project

- A collaborative mindset that sees beyond spreadsheets

- Timely decision-making grounded in market and project insight

This means you gain not just a lender, but a resourceful ally who knows how to get deals done and projects completed.

A Smarter Approach to Financing Value-Add Projects

Successful development doesn’t happen by accident. It’s built on planning, strategic financing, and partnerships that understand how to create value. Here are a few key takeaways we encourage our borrowers to consider:

- Phase-aligned financing is essential. Acquisition, entitlement, and construction each require their own approach.

- Preparation pays off. Lenders respond well to clarity—clear plans, strong feasibility data, and realistic timelines.

- Exit strategy matters. Whether you’re planning to refinance, sell, or stabilize the property, knowing your path forward helps keep financing efficient.

At Fidelis, we thrive in environments where borrowers are ready to move forward but need the right kind of support to get there.

Partnering to Build What’s Possible

At the heart of our work is a belief that thoughtful development creates real, lasting value—not just for investors, but for communities. Whether it’s revitalizing a tired building or reimagining a property’s use, Fidelis is here to help borrowers turn potential into performance.

📞 If you’re ready to discuss a value-add project and want a financing partner who brings insight, agility, and commitment to the table, give us a call at 760-258-4486.

Let’s build something remarkable—together.

Explore how Fidelis can support your growth with flexible, fast financing solutions tailored to your needs.

See Our Latest Performance Report

Fidelis Private Fund annualized yield paid to Limited Partners for the 1st Quarter 2025. Click here for a summary of Fidelis’s annualized yield since inception.

Fidelis Private Fund annualized yield paid to Limited Partners for the 1st Quarter 2025. Click here for a summary of Fidelis’s annualized yield since inception.

Fidelis 2028 Vivid Vision – Where are we going and how are we going to get there!

Fidelis 2028 Vivid Vision – Where are we going and how are we going to get there!

The Fidelis 2028 Vivid Vision document provides a comprehensive blueprint of the company’s strategic direction, core values, and operational principles, highlighting its commitment to capital preservation, growth, innovation, and client-centric services. Click to read the Fidelis vision.