Investing with Fidelis Private Fund offers a strategic balance between achieving higher yields and maintaining access to your funds. It’s a vehicle for long-term growth where reasonable liquidity can be achieved with some foresight and planning without sacrificing the higher yield potential of real estate mortgage investments.

The Ideal Fidelis Investor

The ideal investor for Fidelis Private Fund is someone focused on preserving capital and generating competitive returns for fixed income or compounding growth over the long term. This fund is best suited for those with a long-term investment perspective rather than investors seeking a temporary parking spot for funds before a future investment. Fidelis is not intended as a high-interest paying checking account for short-term financial needs.

The Redemption Process Simplified

At Fidelis, we’ve designed our redemption process to be transparent and efficient, providing clear terms upfront. Withdrawing capital from Fidelis Private Fund requires a 45-day written notice to the General Partner before the calendar quarter. Unless an exception is made, it is processed quarterly, coinciding with income distributions, assuming liquidity is available. There is a one-year minimum commitment for any Fidelis investor, a 10% withdrawal fee for any capital withdrawn within the first year, and no exit fee after one year.

Structured for Stability and Flexibility

Fidelis balances the need for liquidity with the pursuit of long-term growth. Our fund is structured to provide reasonable liquidity – a crucial aspect for any investor. However, the strategic planning and understanding of our redemption process allows for this balance, ensuring that while you have access to your capital when planned for, the fund’s assets are continuously working to maximize growth and stability.

The Trade-Off: Immediate Access vs. Higher Yields

Immediate liquidity often comes at the cost of lower returns. At Fidelis, we focus on maximizing your investment’s growth potential over time. We maximize yield by keeping as much of the investor capital employed in loans as possible. Therefore, the accesss to immediate liquidity is limited. This approach means that while funds may not be as instantly accessible, the return on your investment is geared to be more substantial, reflecting the diligent, growth-focused strategies we employ.

Conclusion

Fidelis Private Fund is committed to a clear, fair, and structured redemption process, emphasizing the importance of liquidity coupled with the pursuit of long-term growth. By investing with Fidelis, you’re choosing a path of thoughtful financial planning and strategic investment aimed at higher yield opportunities. We value your present and future financial success, offering a partnership that thoughtfully and effectively navigates the balance between liquidity and long-term wealth accumulation.

Invest with Fidelis and align with a fund that understands the importance of planning ahead, offering structured liquidity options without compromising on the growth potential of your investments.

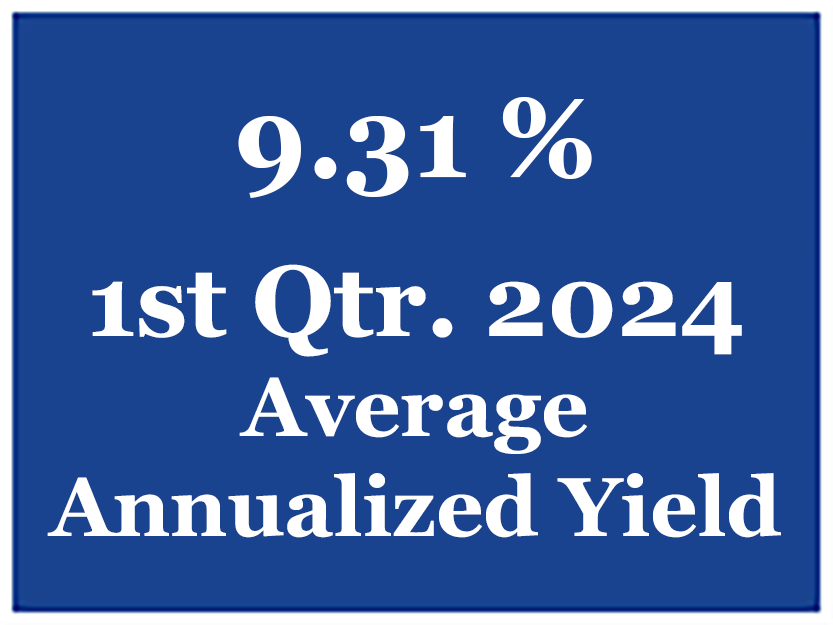

Fidelis Private Fund annualized yield paid to Limited Partners for the first quarter of 2024 was 9.31%. Click here for a summary of Fidelis’s annualized yield since inception.

Fidelis Private Fund annualized yield paid to Limited Partners for the first quarter of 2024 was 9.31%. Click here for a summary of Fidelis’s annualized yield since inception.

Fidelis 2028 Vivid Vision – Where are we going and how are we going to get there!

Fidelis 2028 Vivid Vision – Where are we going and how are we going to get there!

The Fidelis 2028 Vivid Vision document provides a comprehensive blueprint of the company’s strategic direction, core values, and operational principles, highlighting its commitment to capital preservation, growth, innovation, and client-centric services. Click to read the Fidelis vision.