When it comes to real estate investing, speed, flexibility, and strategic growth are the three pillars of success. While traditional banks and financial institutions may offer lower interest rates, their rigid requirements, lengthy approval processes, and stringent underwriting can slow down an investor’s ability to capitalize on opportunities. This is where private lending steps in as a game-changer.

Private lending, like the solutions provided by Fidelis Private Fund, allows investors to move quickly, close deals efficiently, and maintain the momentum necessary for portfolio expansion. However, as with any financial strategy, investors should carefully consider the potential risks, such as higher interest rates and shorter loan terms, and ensure that private lending aligns with their overall investment strategy. Let’s explore why private lending is the preferred choice for savvy real estate investors and how Fidelis is implementing these advantages to fuel growth.

The Limitations of Traditional Loans

Traditional banks operate with strict underwriting guidelines that can sometimes slow down real estate investors who need fast access to capital. While they provide stability and lower-cost financing for long-term investments, their approval processes may not always align with time-sensitive opportunities. Common hurdles include:

- Slow Approval Process: Banks can take 30-60 days or more to approve loans, often causing investors to miss out on lucrative deals.

- Stringent Credit Requirements: Borrowers must meet high credit score thresholds and extensive financial documentation requirements.

- Rigid Loan Terms: Traditional loans come with strict amortization schedules, high prepayment penalties, and little room for customization.

- Limited Loan Purposes: Many banks hesitate to fund fix-and-flip projects, construction loans, or unconventional properties.

For real estate investors, these constraints can create missed opportunities and slow portfolio growth. Enter private lending.

The Private Lending Advantage: Speed, Flexibility, & Strategic Growth

1. Speed: Close Deals Fast

Private lenders like Fidelis understand that time is money in real estate. Investors need quick access to capital to secure properties before the competition. Fidelis streamlines underwriting, often funding deals in a matter of days—not weeks or months.

Fidelis in Action: Fidelis Private Fund provides fast approvals and flexible financing solutions tailored to an investor’s unique needs. With a simplified application process and rapid decision-making, investors can capitalize on market opportunities without delay.

2. Flexibility: Tailored Loan Structures

Unlike banks, private lenders can customize loan terms based on the specifics of a project rather than relying solely on credit scores and rigid guidelines. This allows for:

- Interest-only payment options

- No prepayment penalties

- Asset-based lending with a focus on property value rather than extensive financial history

Fidelis in Action: Fidelis offers a variety of specialized loan products, including bridge loans, construction loans, and value-add project financing, ensuring that borrowers get a loan structure that aligns with their investment strategy.

3. Strategic Growth: Scaling Without Limits

Real estate investors must continuously acquire, renovate, and sell or lease properties to scale their portfolios. Private lenders support this by providing recurring funding and treating investors as long-term partners, rather than just numbers in a system.

Fidelis in Action: Fidelis takes a relationship-driven approach, working with repeat borrowers to ensure seamless access to capital for future projects. Investors can rely on pre-approved credit lines, allowing them to move forward confidently on new acquisitions.

Why Fidelis Private Fund?

Why Fidelis Private Fund?

Fidelis Private Fund isn’t just another private lender—it’s a trusted financial partner committed to transparency, flexibility, and fast execution. Investors working with Fidelis benefit from:

- Common-sense underwriting that evaluates deals holistically, rather than relying on rigid formulas.

- Dedicated account managers who understand investors’ needs and provide tailored solutions.

- Funding within days, ensuring deals don’t fall through due to financing delays.

- A relationship-based model that prioritizes long-term growth and repeat business.

Ready to Scale Your Portfolio with Private Lending?

The real estate market moves fast—shouldn’t your financing move with it? If you’re ready to unlock new opportunities with fast, flexible, and strategic financing, Fidelis Private Fund is here to help.

For personalized guidance, connect with our team today. Call Fidelis Private Fund now at 760-258-4486 and schedule a meeting with our experts to discuss your investment goals. Our experienced team has helped countless investors navigate market uncertainty and build resilient portfolios with confidence. Let us guide you toward a secure and profitable investment future.

Let’s build a resilient financial future together.

Visit fidelispf.com or call us at 760-258-4486 to learn how Fidelis can help you achieve stability and consistent growth in your portfolio.

See Our Latest Performance Report

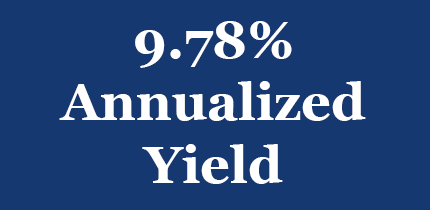

Fidelis Private Fund annualized yield paid to Limited Partners for the 1st Quarter 2025. Click here for a summary of Fidelis’s annualized yield since inception.

Fidelis Private Fund annualized yield paid to Limited Partners for the 1st Quarter 2025. Click here for a summary of Fidelis’s annualized yield since inception.

Fidelis 2028 Vivid Vision – Where are we going and how are we going to get there!

Fidelis 2028 Vivid Vision – Where are we going and how are we going to get there!

The Fidelis 2028 Vivid Vision document provides a comprehensive blueprint of the company’s strategic direction, core values, and operational principles, highlighting its commitment to capital preservation, growth, innovation, and client-centric services. Click to read the Fidelis vision.