In the complex world of real estate investing, achieving a balance between risk and return is crucial. One strategy that has proven invaluable in this pursuit is strategic portfolio diversification with alternative investments. While traditional assets like stocks and bonds have their merits, alternative investments offer untapped potential, particularly real estate mortgage funds.

Why Diversification Matters

True diversification isn’t merely about spreading investments across various asset types; it’s a strategic approach to improve potential returns while minimizing risk. For instance, real estate mortgage funds offer additional protection for your investments by potentially boosting returns through diversification.

Real Estate Mortgage Funds: Diversifying Beyond the Traditional

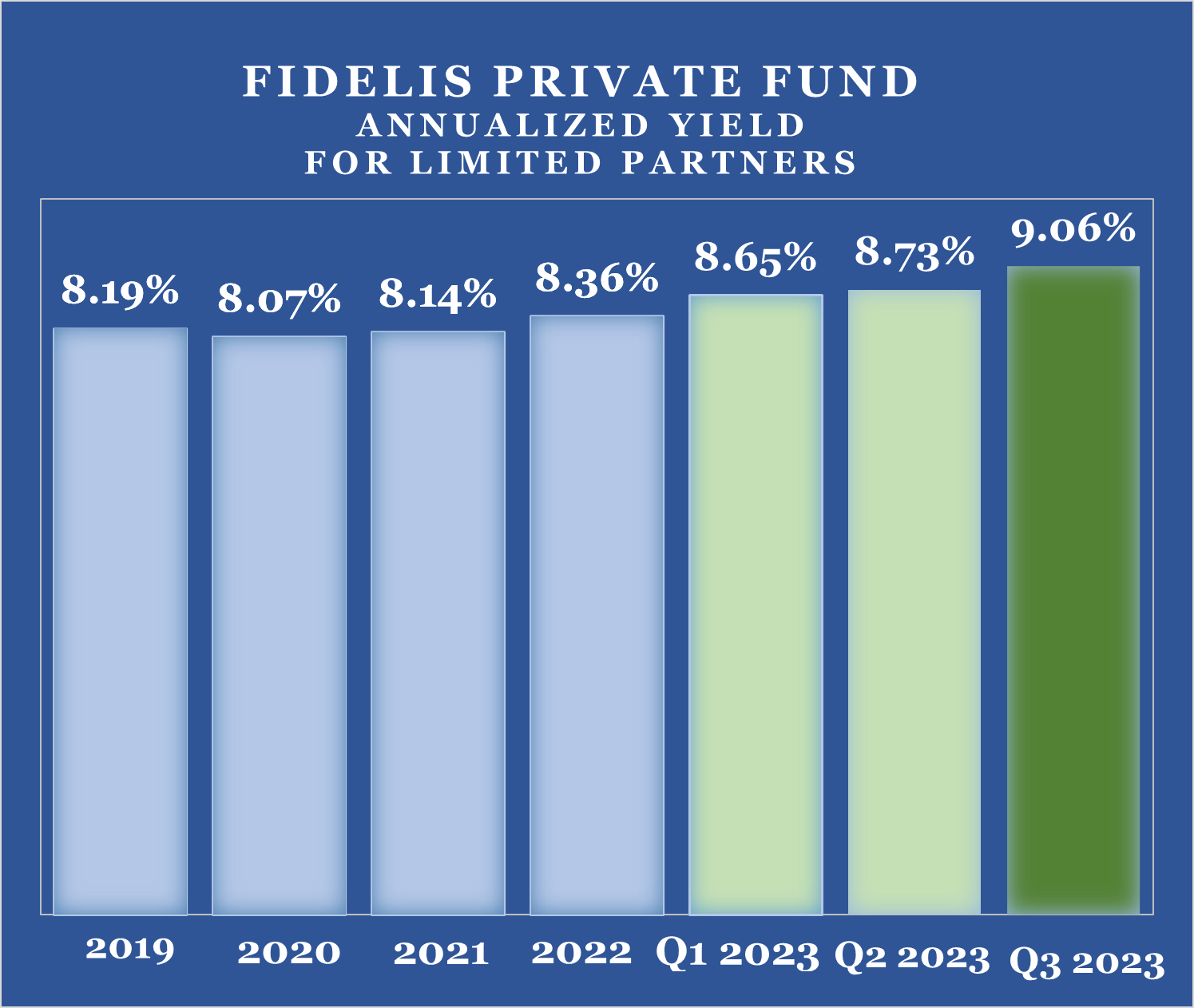

Real estate mortgage funds are gaining traction as a significant component of a well-diversified portfolio due to their typically low correlation with standard financial markets. This characteristic serves as a cushion during periods of market volatility. Backed by tangible assets, these funds often deliver competitive yields, marking them as an attractive option for investors seeking growth. Evidence of this can be seen in Fidelis Private Fund’s proven track record, which boasts consistent, competitive yields for its investors since inception.

Leveraging Expertise and Technology

The key to unlocking the full potential of strategic portfolio diversification is the combination of expert fund management with advanced technology. Experienced fund managers are critical in selecting and managing investment opportunities, while technology enhances portfolio analysis, risk assessment, and optimization. At Fidelis, we take utilizing technology seriously, knowing that the more efficient we are, the more our investors benefit.

Conclusion

Strategic diversification within your investment portfolio, especially in alternative investments like real estate mortgage funds, can help maximize yield. It’s not just about adding different asset classes; it’s about optimizing each to work in your favor. Your quest for maximizing yield is in strategic diversification, and alternative investments are a great investment strategy.