Adopting a long-term investment perspective is crucial for prospective investors exploring opportunities in mortgage funds, such as those offered by Fidelis Private Fund. Understanding the value and impact of a long-term view in this specific investment arena can significantly influence the success and satisfaction of your investment journey.

Why a Long-Term Perspective Matters in Mortgage Fund Investments:

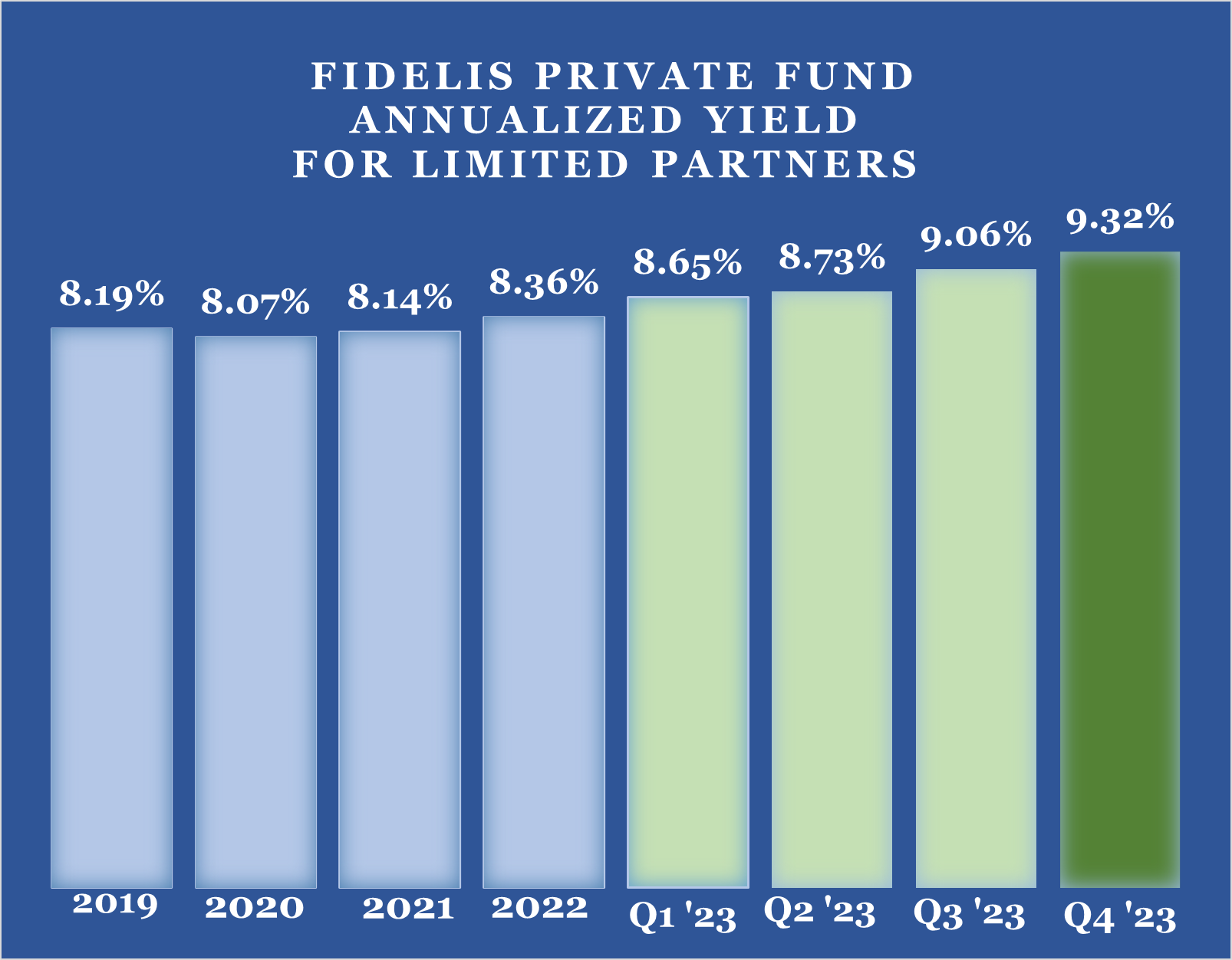

1. Compound Growth Potential: Mortgage funds, by their nature, offer compounding returns over time. A long-term investment horizon allows investors to fully benefit from this compounding effect, where returns are reinvested to generate further earnings. Fidelis Private Fund, for example, capitalizes on this principle to enhance the growth potential of your investment. The annualized yield Fidelis provides its investors is over 9%; at this rate, your investment will double in a little over seven years with compounding.

2. Navigating Market Fluctuations: The real estate market, and by extension mortgage funds, can experience periods of volatility. A long-term perspective equips investors to ride out short-term market fluctuations, avoiding knee-jerk reactions to temporary market changes. This approach can lead to more stable and potentially higher returns over time.

3. Reduced Impact of Entry and Exit Timing: By investing long-term, you reduce the pressure and risks of trying to time the market. This approach negates the need for perfect market entry and exit timing, which is often challenging and unpredictable. Fidelis Private Fund has consistently generated over an 8% annualized yield to investors since its inception.

4. Aligned Investment Goals: For investors with long-term goals such as retirement planning, wealth preservation, or legacy building, mortgage funds like Fidelis Private Fund offer a suitable investment vehicle. These funds are designed to align with and support long-term financial objectives.

For those not already invested in a mortgage fund like Fidelis and considering an investment in a mortgage fund, it’s essential to recognize the value of a long-term investment perspective. Funds like Fidelis Private Fund are structured to provide optimal benefits over an extended period, aligning well with long-term financial planning and wealth growth strategies. Adopting this perspective can lead to a more fruitful and less stressful investment experience, allowing your investment to grow and mature alongside your financial goals.

Fidelis Private Fund annualized yield paid to Limited Partners for the fourth quarter of 2023 was 9.32%. Click here for a summary of Fidelis’s annualized yield since inception.

Fidelis Private Fund annualized yield paid to Limited Partners for the fourth quarter of 2023 was 9.32%. Click here for a summary of Fidelis’s annualized yield since inception.

Fidelis 2028 Vivid Vision – Where are we going and how are we going to get there!

Fidelis 2028 Vivid Vision – Where are we going and how are we going to get there!

The Fidelis 2028 Vivid Vision document provides a comprehensive blueprint of the company’s strategic direction, core values, and operational principles, highlighting its commitment to capital preservation, growth, innovation, and client-centric services. Click to read the Fidelis vision.