Increasing leverage or debt is an alternative to raising capital through giving up ownership equity. However, giving up ownership equity can be costly and is usually more expensive than debt.

I often get the request from a borrower asking, “How can I get a larger loan amount to take advantage of this opportunity?”

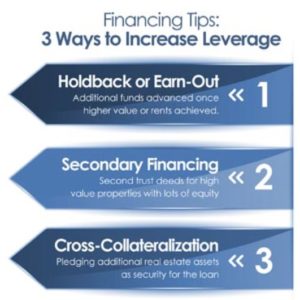

In today’s market, justifying the request for increased leverage or debt on income property acquisitions can be difficult to achieve with the low cap rates and the possibility of higher interest rates on the horizon. However, here are three ways I can assist borrowers in structuring loans to help maximize leverage when acquiring and refinancing real estate investment property:

- Holdback or Earn-Out is a promise by the lender to advance more money in the future on the original loan disbursement once the borrower achieves a higher level of rental income or meets some identified threshold where value is added. For example, you purchase an apartment with below-market rents, and you plan on doing some remodeling and raise rents, thereby creating a higher value justifying additional loan dollars. The additional loan commitment or holdback (earn -out) would be released once those higher rents are achieved.

- Mezzanine Debt or Secondary Financing is usually in the form of a 2nd Trust Deed. The ability to enhance leverage using mezzanine debt is used with high opportunity/transition type properties where significant value is added in a short period. Also, where the source of repayment is in the near term or where properties are under secured already, and there is plenty of equity to support secondary debt in the form of 2nd Trust Deeds. Another form of mezzanine debt is pledged ownership interest, a whole other topic for another time which we won’t get into here. However, it is an option in the market.

- Cross-Collateralization is pledging additional real estate assets besides the subject property as security for the loan. This allows the borrower to increase the loan amount requested over and above what would normally be secured by just the subject property alone. For example, a borrower who is looking to purchase an income property and does not have sufficient cash down payment can use cross-collateralization as a way to increase the loan amount needed to purchase the property. If the borrower has other income properties with sufficient equity either in a 1st or 2nd trust deed position, the lender could cross-collateralize the loan reducing or possibly eliminating the down payment depending on the amount of real equity provided as cross-collateral.

Increasing leverage is an alternative to giving up ownership equity and nobody wants to give ownership equity away if they don’t have to which is why before saying, “no” to any loan request, I always look for a way to help the borrower structure a loan where it is a win/win for all parties involved.

How have you been successful in getting higher leverage on your loans? Do you have someone in your corner to help you make it happen?